Data from the Australian Bureau of Statistics (ABS) revealed a 2.3% increase in Australia's headline inflation over the 12 months to November, up from 2.1% in October, with core inflation indicators highlighting ongoing price pressures.

When excluding volatile items and holiday travel, consumer prices increased by 2.8% in November, up from 2.4% in October.

At the same time, the Reserve Bank of Australia’s (RBA) trimmed mean inflation, an alternative measure of core inflation, registered at 3.2% in November, slightly lower than October’s 3.5% but still exceeding the central bank’s target range of 2% to 3%.

Key details from the data showed:

- Significant gains were recorded in Food and non-alcoholic beverages (+2.9%), Alcohol and tobacco (+6.7%), and Recreation and culture (+3.2%).

- Declines in Electricity (-21.5%) and Transport (-2.4%) helped offset broader price increases.

- Housing costs remained high, with rents rising 6.6% year-over-year.

While November’s inflation figures indicated some moderation in core measures, they underscore the challenges the RBA faces in bringing inflation sustainably back within its target range.

However, the widening interest rate gap with the U.S. and mounting expectations of earlier rate cuts are likely to maintain downward pressure on the Australian dollar in the near term.

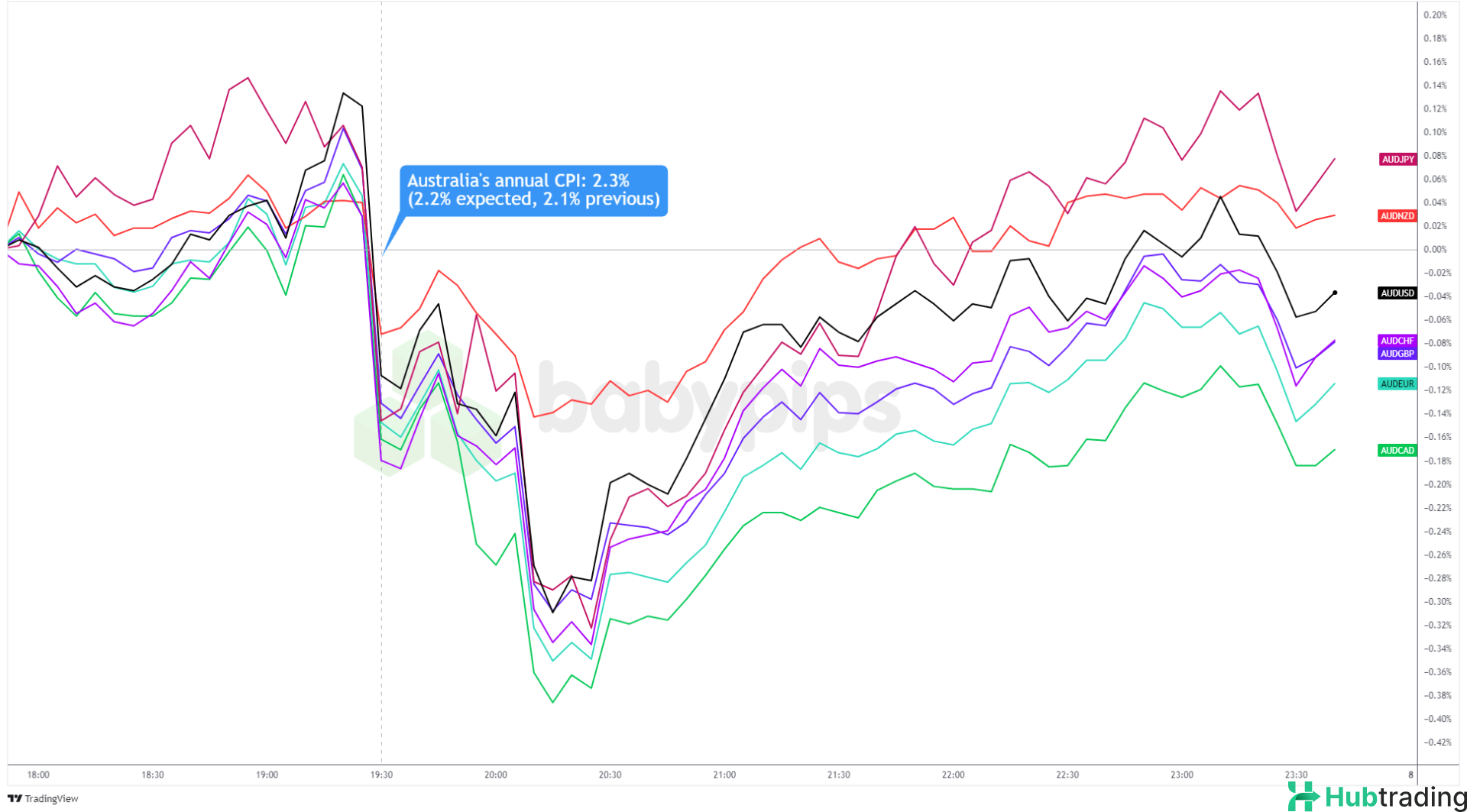

Australian Dollar Performance Against Major Currencies: 5-Min Chart Update

The Australian dollar, which had been recovering some losses from the U.S. session, saw a sharp drop following the release of the CPI data.

The reaction suggests traders are increasingly betting on earlier RBA rate cuts, despite persistently sticky core inflation. Market expectations for a February rate cut have risen to 61%, up from 51% prior to the data. By year-end, rates are projected to fall to around 3.57%, compared to U.S. rates, which are expected to peak near 3.95%.

Adding to the pressure, the yield spread has turned against the Aussie. Australian bonds now offer lower returns than U.S. Treasuries—a significant reversal from just a few months ago. This shift in yield advantage has further weighed on the Australian dollar.

However, the AUD began rebounding about an hour after the CPI release, likely driven by improved risk sentiment and optimism surrounding potential stimulus measures from China. As of now, the AUD is trading just below its pre-CPI levels against major currencies.