- Canada’s December inflation report, set to release on Tuesday, is expected to show headline CPI rising 1.8% YoY, slightly below November’s 1.9% increase.

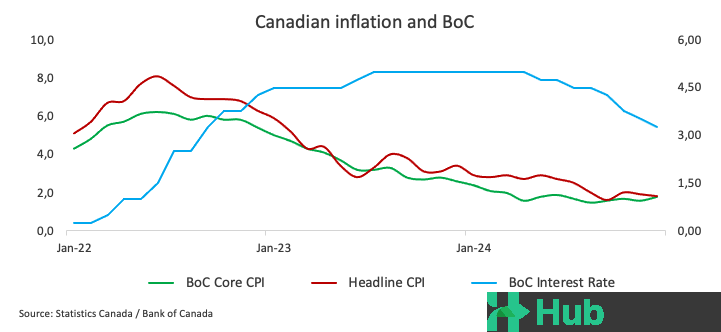

- The Bank of Canada’s interest rate policy, which saw 175 basis points of cuts in 2024, remains a key focus amid economic uncertainty.

- The Canadian Dollar trades near multi-year lows against the US Dollar, with USD/CAD surpassing the 1.4500 level, reflecting persistent market pressures.

Statistics Canada reported a modest easing in the nation’s inflation rate for December. The Consumer Price Index (CPI), which measures the cost of goods and services, increased by 1.8% year-over-year, down from November’s 1.9% rise and slightly below analysts’ expectations of 1.9%. On a monthly basis, prices declined by 0.4%, following a flat reading in November.

The Bank of Canada’s Core CPI, which excludes volatile items like food and energy, showed some resilience, rising 1.8% year-over-year in December, up from 1.6% in November. However, on a monthly basis, core inflation fell by 0.3%, adding to the 0.1% drop recorded in the prior month.

Market Reaction to Canadian CPI

Following the release of the inflation data, the Canadian Dollar weakened, reversing Monday’s gains. This allowed USD/CAD to break above 1.4500, reaching new yearly highs during Tuesday’s trading session.

Preview: Canada’s December Inflation Report and Its Impact on USD/CAD

• Key Expectations: The Canadian Consumer Price Index (CPI) is projected to rise by 1.8% YoY in December.

• Rate Cuts in Focus: The Bank of Canada (BoC) has reduced its policy rate by 175 basis points in 2024.

• Currency Pressures: The Canadian Dollar (CAD) remains under pressure, trading at multi-year lows against the US Dollar (USD).

Canada’s Inflation Outlook

Statistics Canada is set to release its December inflation report on Tuesday at 13:30 GMT. Analysts expect headline CPI to climb 1.8% year-over-year, down from November’s 1.9% and marginally below the BoC’s 2% target. On a monthly basis, prices are forecast to decline by 0.2%, reflecting seasonal headwinds and weaker core goods demand.

The BoC’s Core CPI, which excludes volatile items such as food and energy, will also be closely watched. November’s core inflation rose by 1.6% YoY but contracted by 0.1% MoM. Analysts expect core CPI to edge lower, averaging 2.45% YoY, as trimmed and median measures may exceed the BoC’s Q4 projections.

Interest Rate Policy and Market Sentiment

The BoC’s decision to cut rates by 50 basis points to 3.25% in December was contentious, with some policymakers favoring a smaller 25 bps reduction. Governor Tiff Macklem hinted that future rate cuts would likely proceed at a slower pace, reflecting the central bank’s cautious approach to balancing growth concerns and inflation risks.

TD Securities anticipates that any upside surprise in inflation data could be attributed to elevated food prices and the weaker Canadian Dollar. However, they expect the BoC to maintain its current rate outlook, even if core inflation slightly overshoots projections.

USD/CAD Outlook

The USD/CAD pair has been consolidating near multi-year highs, recently breaking past the 1.4500 level. The pair’s strength is underpinned by a strong US Dollar, driven by the so-called “Trump trade,” and volatility in crude oil prices, which continues to weigh on the Canadian Dollar.

Pablo Piovano, Senior Analyst at FXStreet, suggests that USD/CAD could test 2024 highs at 1.4485, with the next major resistance at the 2020 peak of 1.4667. On the downside, key support levels include the January low of 1.4278, the 55-day Simple Moving Average (SMA) at 1.4177, and the psychological 1.4000 mark. Breaking below these levels could expose the November low of 1.3823 and the 200-day SMA at 1.3816, with additional selling pressure potentially targeting the September low of 1.3418.

Market Reaction

The Canadian Dollar’s response to the CPI data will depend on how much it diverges from expectations. A softer reading may add to the currency’s weakness, driving USD/CAD higher, while a stronger print could offer temporary relief for the Loonie. However, with persistent gains in the Greenback and ongoing uncertainty in commodity markets, the CAD may remain on the defensive for the foreseeable future.