In the U.S. today, the Producer Price Index (PPI) was released, revealing a modest increase of just 0.1% in July, below the anticipated 0.2%.

Excluding food and energy, the core PPI remained unchanged. The year-over-year headline PPI saw a significant decline, dropping from 2.7% in June to 2.2% in July.

This led to a shift in market expectations, with traders anticipating a quicker pace of interest rate cuts by the Federal Reserve. Consequently, the U.S. dollar experienced a sharp decline.

The Producer Price Index (PPI) measures the prices of a broad array of goods and services in the U.S., ranging from raw materials to finished products, at the wholesale level.

Traders and analysts closely watch the PPI because it reflects the prices producers pay for inputs, often serving as an early signal of inflation that could later impact consumers.

If producers encounter higher input costs, they may pass these costs onto consumers by raising prices, which could eventually appear in consumer inflation metrics such as the Consumer Price Index (CPI) and the Fed’s preferred inflation gauge, Core PCE.

With the Bureau of Labor Statistics (BLS) set to release the July CPI report tomorrow, it has become the key focus for gaining a clearer perspective on inflation.

Last month, we witnessed a significant drop in the month-over-month change, with a negative reading of -0.06%—the first in nearly two years and the lowest since May 2020.

For tomorrow’s report, the consensus expectation is for a rebound to a positive 0.2% month-over-month increase.

The outcome of Wednesday’s CPI report will be crucial in determining whether the U.S. dollar’s current downtrend continues or sees a reversal.

For a deeper dive into what to watch for, check out our Event Guide: U.S. CPI Report (July 2024), available exclusively to Premium members.

Currency Market Movers:

Let’s take a look at today’s forex price action.

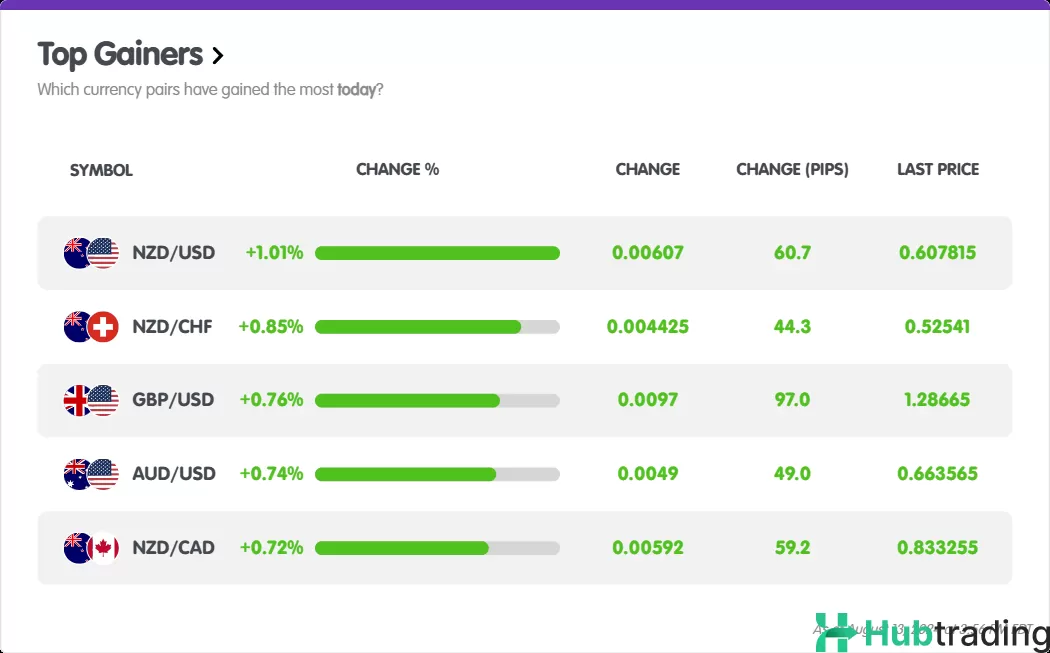

Which currency pairs were the top performers today?

NZD/USD led the charge, climbing 1.01% or 60 pips.

According to our FX Market Movers page, NZD/CHF and GBP/USD secured the second and third spots, respectively.

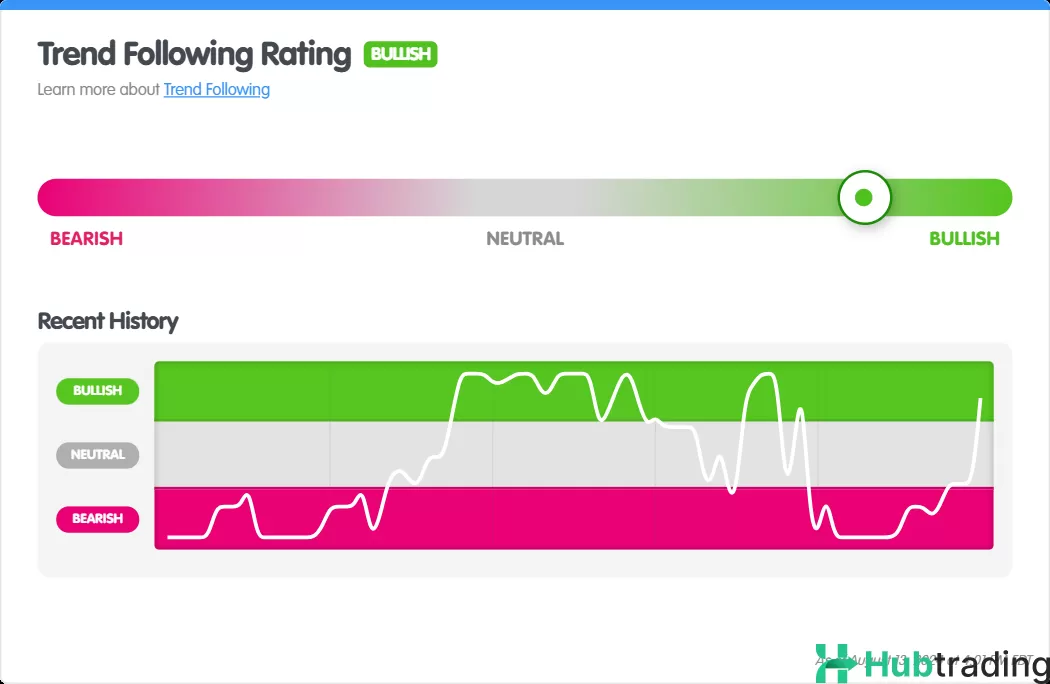

The NZD/USD Trend Following Rating is currently indicating a Bullish outlook.

The currency pair has successfully moved back above most of its major moving averages, with the 200 SMA serving as the only remaining dynamic resistance.

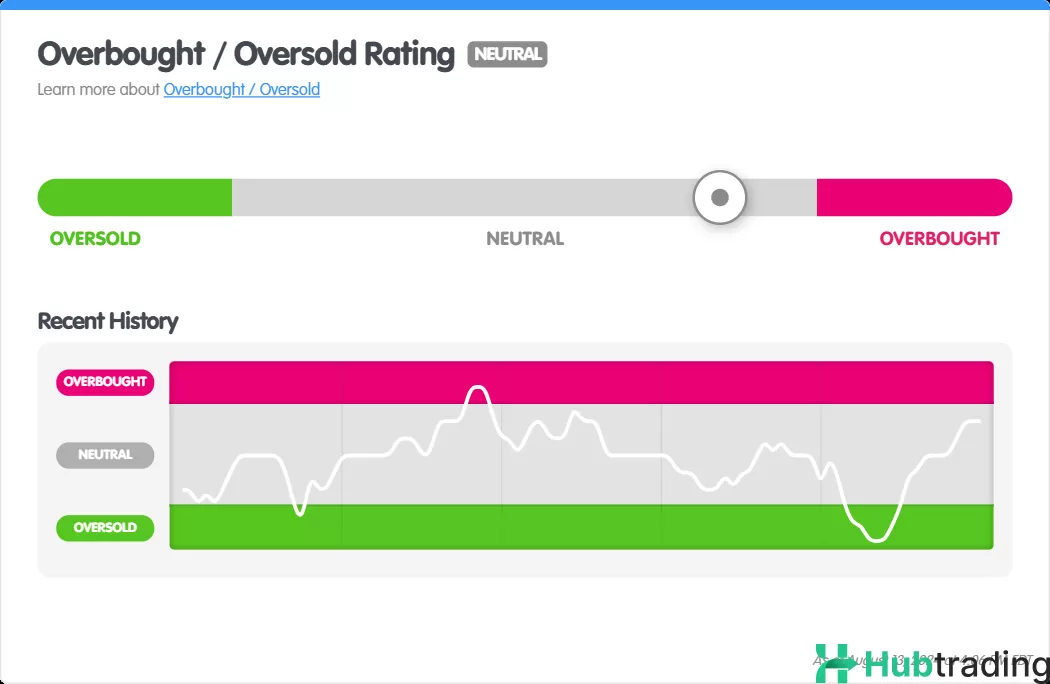

However, the NZD/USD Overbought/Oversold Rating is currently indicating a "Neutral" stance.

⚠️ Exercise caution! The New Zealand dollar could experience significant volatility soon.

Tomorrow, the Reserve Bank of New Zealand (RBNZ) is set to announce its decision on the official cash rate.

The RBNZ is expected to begin reversing its current monetary policy stance by cutting the key interest rate by 0.25%, bringing it down to 5.25%.

If you're a Premium member, be sure to check out our Event Guide: RBNZ Monetary Policy Statement (August 2024) to prepare yourself. ?

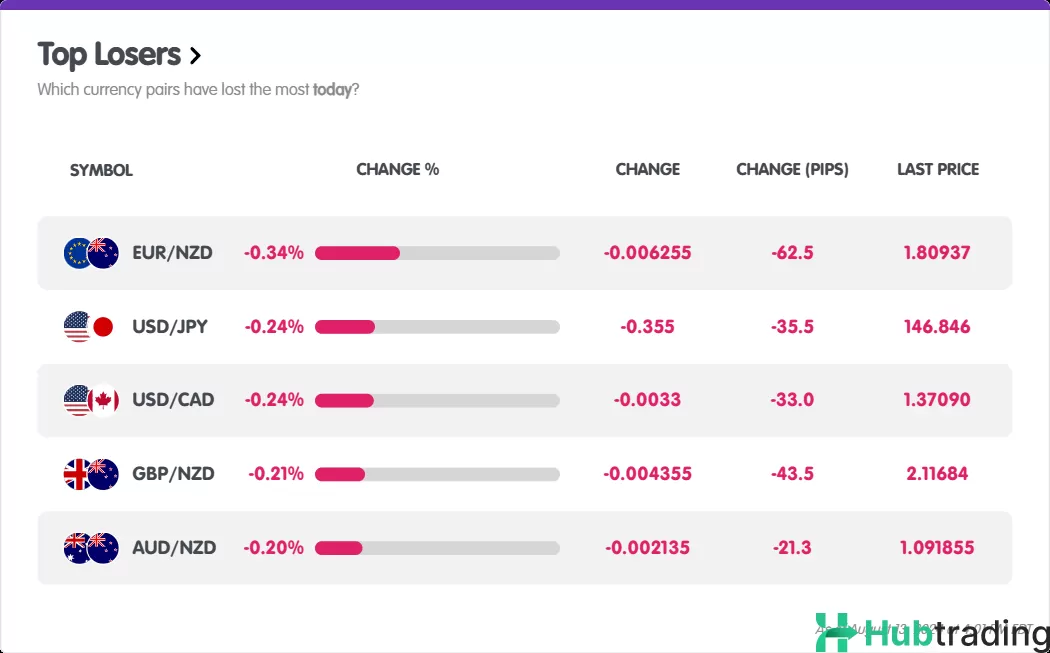

Which currency pairs experienced the largest losses today?

EUR/NZD was the biggest decliner, dropping 0.34% or 62 pips.

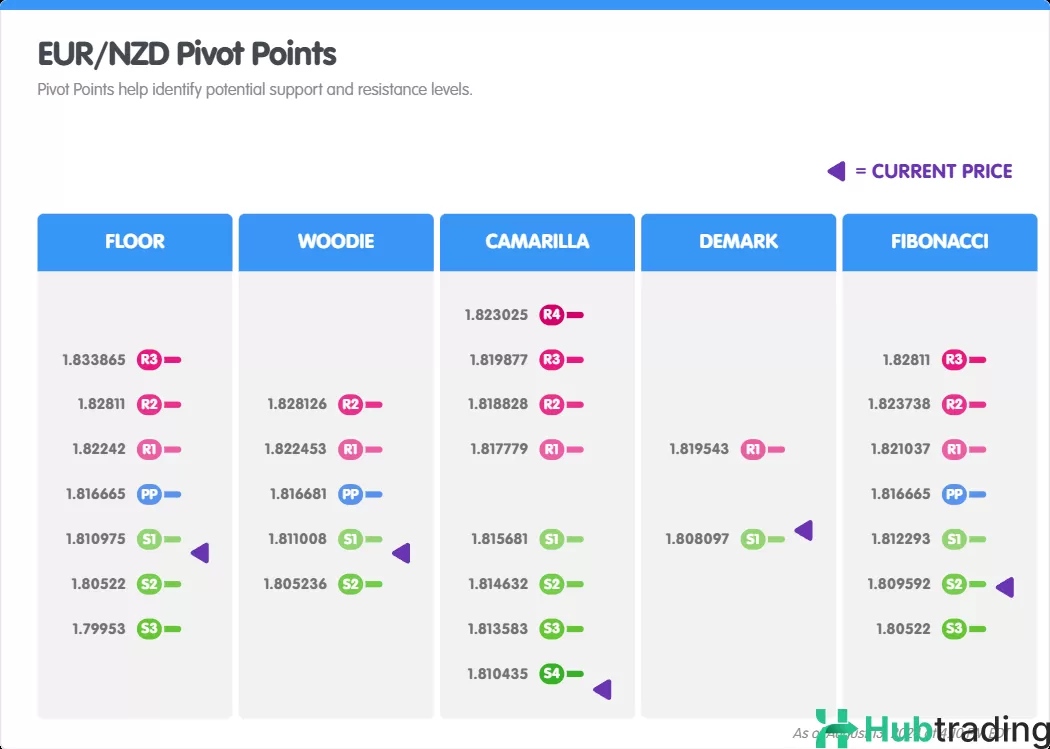

Examining the EUR/NZD Pivot Points, it appears the price is currently trading near key support levels.

Currency Strength:

How did individual major currencies perform today?

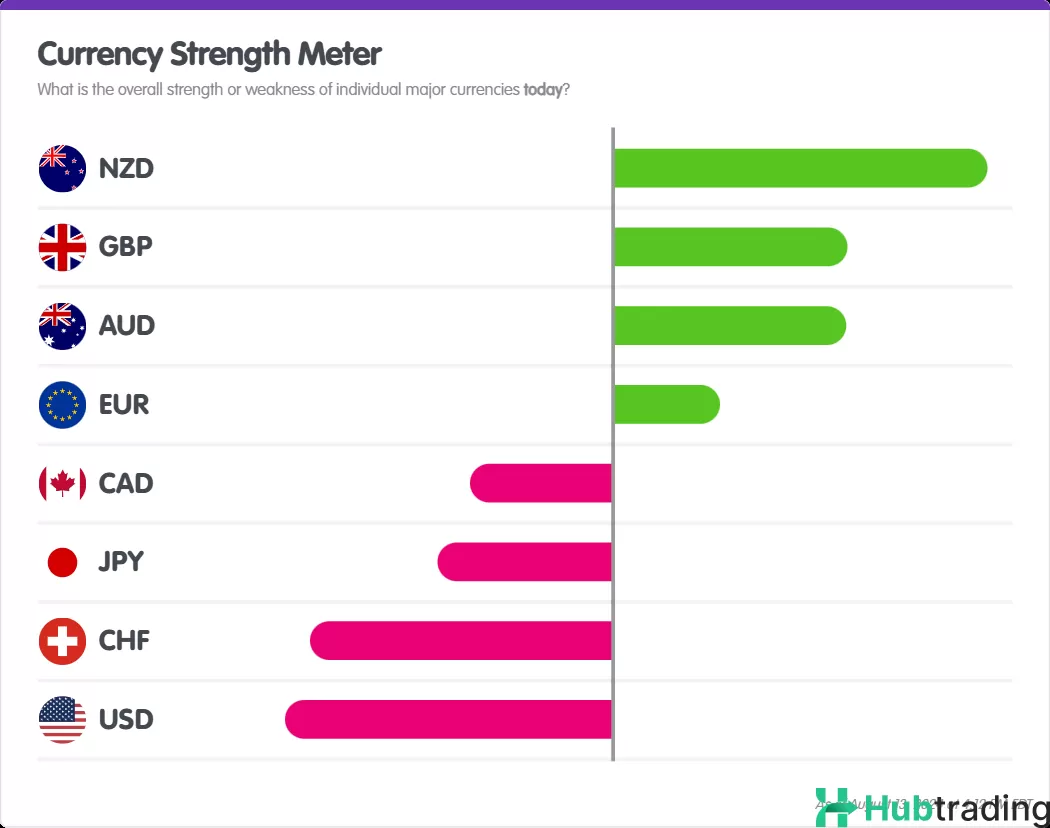

According to the Currency Strength Meter on MarketMilk™, the NZD emerged as the strongest currency, while the USD was the weakest.

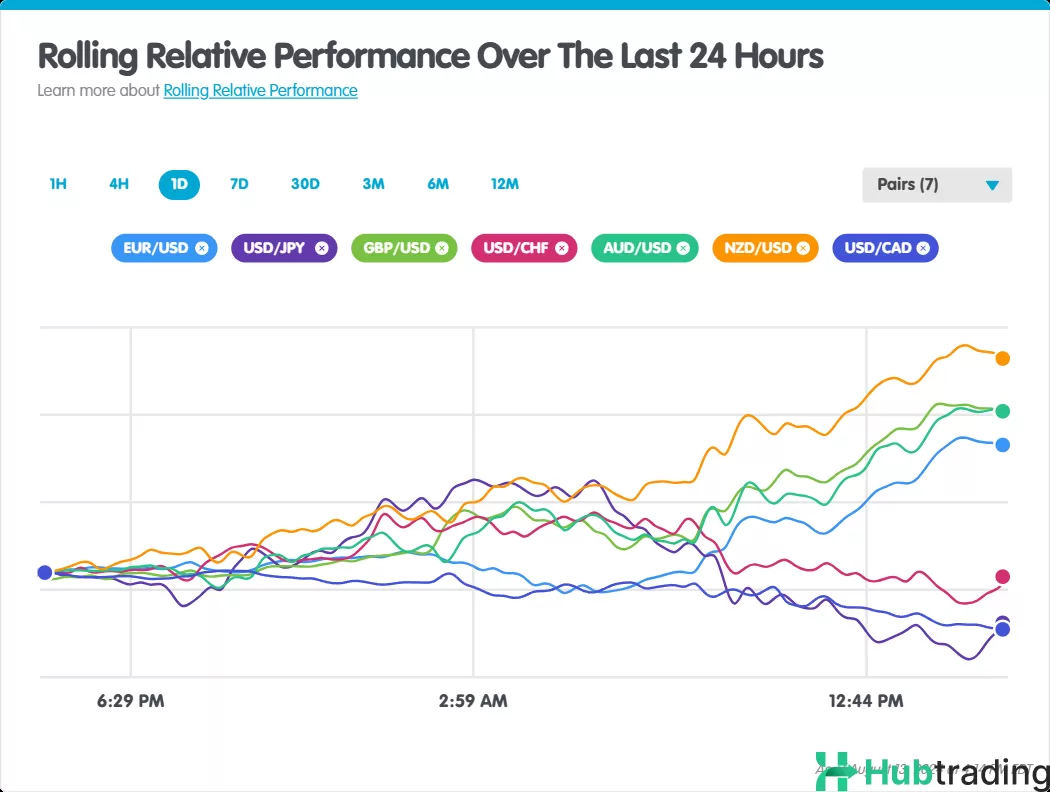

Examining the movement of major currency pairs over the past 24 hours reveals that NZD/USD surged significantly following the PPI release.