Cooler producer price pressures in the U.S. sparked speculation about potential Fed rate cuts and encouraged increased risk-taking in the markets.

How did your preferred assets perform on Tuesday?

Let’s review the major headlines that captured attention:

Headlines:

-

Westpac: Australia's consumer sentiment index rose from 82.7 to 85.0 in August, reflecting reduced concerns about further rate hikes from the RBA.

-

Australia Wage Price Index for Q2 2024: Increased by 0.8% quarter-over-quarter, matching expectations but slightly below the previous quarter’s rate of 0.9%.

-

NAB: Australian business confidence dropped from a revised 3 to 1 in July.

-

Japan: Preliminary machine tool orders grew by 8.4% year-over-year in July, following a 9.7% increase in June.

-

U.K.: Claimant count change for July was 135K, higher than the 14.5K expected and up from 36.2K previously. The unemployment rate eased from 4.4% to 4.2% in June, while average earnings decelerated from 5.7% to 4.5% in the three months to June.

-

International Energy Agency (IEA): Maintained its global oil demand forecast for 2024 but revised it lower for 2025 due to a weak outlook for China.

-

German ZEW Economic Sentiment for August: Recorded at 19.2, below the expected 32.6 and down from 41.8 previously.

-

Euro Area ZEW Economic Sentiment: Plummeted from 43.7 to 17.9 in August, missing the 35.4 expectation.

-

China: New bank loans contracted sharply from 2.13T CNY to 260B CNY in July.

-

U.S. NFIB Small Business Optimism Index: Increased from 91.5 to 93.7 in July, reaching its highest level since February 2022.

-

U.S. Producer Price Index (PPI) for July: Rose by 0.1% month-over-month, falling short of the 0.2% expected. Core PPI eased from 0.3% to 0.1%, with annual PPI slowing from 2.7% to 2.2%.

-

FOMC Voting Member Raphael Bostic: Indicated that a rate cut “is coming,” but requires “a little more data” before supporting lower interest rates.

-

API: Reported a draw of 5.205 million barrels in inventories for the week ending August 9, against an anticipated 2 million-barrel dip.

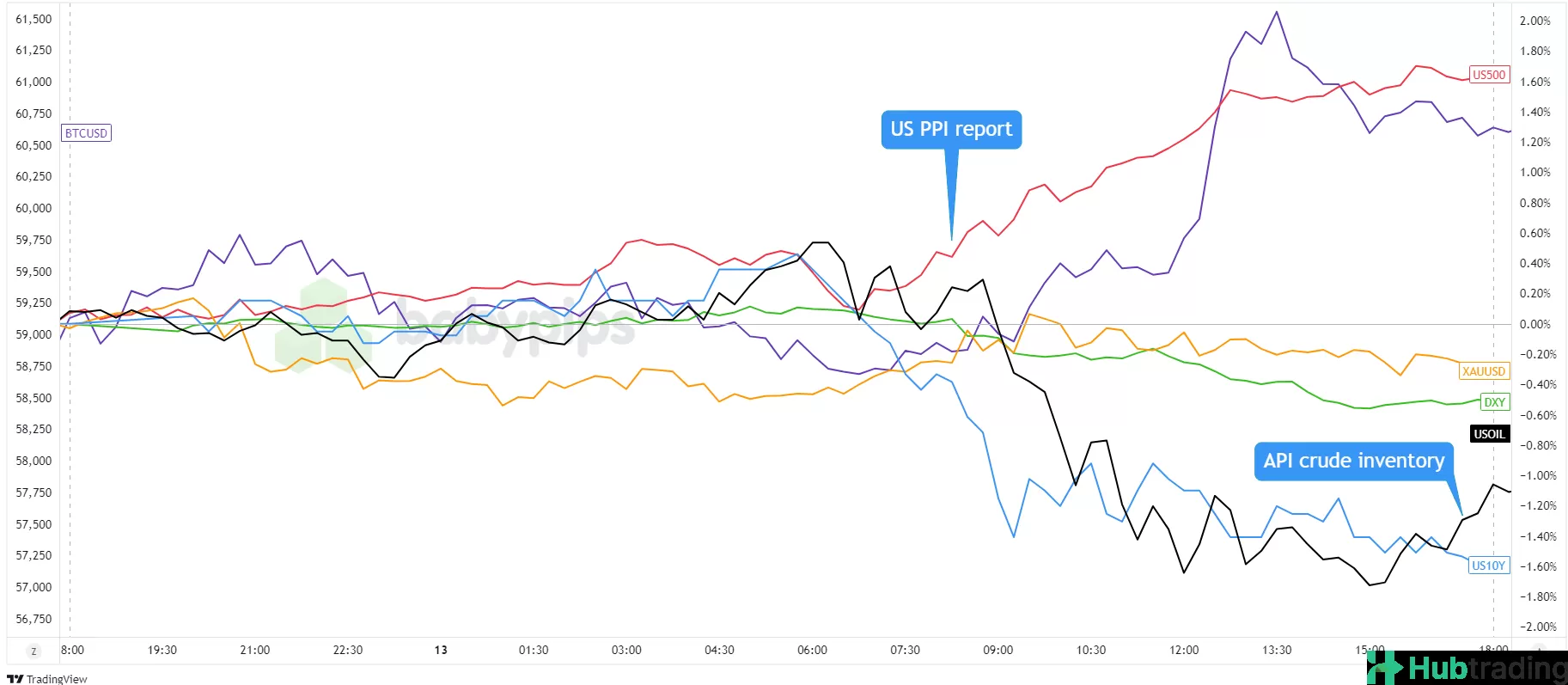

Broad Market Price Action:

The return of Japanese traders from their holidays didn’t significantly impact major assets during the Asian session, which saw markets trading within tight ranges as participants awaited more crucial data releases.

However, activity picked up in the U.S. session. Weak U.S. PPI reports fueled speculation that the Federal Reserve might cut interest rates sooner rather than maintaining a higher-for-longer stance. This anticipation, combined with reduced concerns over Middle East tensions, provided a boost to U.S. equities. The S&P 500 reached two-week highs near 5,430, while the NASDAQ surpassed the 19,000 mark. Additionally, U.S. 10-year Treasury yields fell to 3.85%, and gold prices held steady under $2,475.

On the other hand, U.S. crude oil prices did not join the risk rally. This was likely due to diminished Middle East tensions and revised demand forecasts by OPEC and the IEA, reflecting weaker Chinese demand expectations. WTI crude oil tested the $80.00 level but ended the day closer to $78.40.

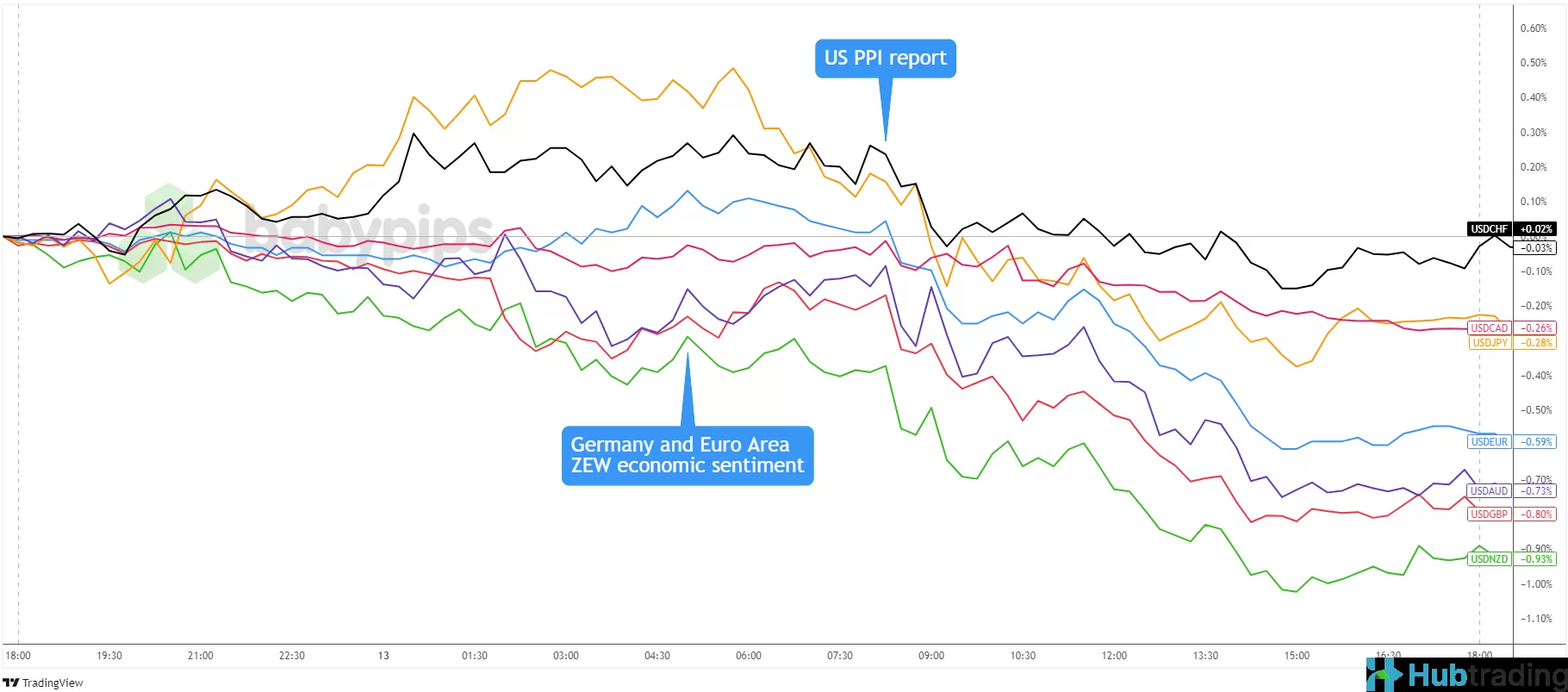

FX Market Behavior: U.S. Dollar vs. Majors:

Forex markets were influenced by specific catalysts early in the day. The return of Japanese traders led to increased pressure on the yen during the Asian session. Meanwhile, the Australian dollar (Aussie) and New Zealand dollar (Kiwi) saw support due to persistently high wage pressures in Australia and positioning in anticipation of the Reserve Bank of New Zealand (RBNZ) decisi

The British pound surged following a drop in the U.K.’s unemployment rate but struggled to maintain those gains as focus shifted to weaker wage growth data. The euro, which had weakened during late Asian trading, showed little reaction to the German ZEW economic sentiment index falling to its lowest level in two years.

During the U.S. session, the dollar weakened broadly in response to disappointing U.S. PPI reports, which fueled speculation about potential Fed rate cuts. This shift in sentiment led to a drop in U.S. 10-year Treasury yields and fostered increased risk-taking across the markets.

Upcoming Potential Catalysts on the Economic Calendar:

- U.K. CPI Reports: 6:00 am GMT

- France Final CPI: 6:45 am GMT

- U.K. House Price Index: 8:30 am GMT

- Euro Area Quarterly Employment Change: 9:00 am GMT

- Euro Area Flash GDP: 9:00 am GMT

- Euro Area Industrial Production: 9:00 am GMT

- U.S. CPI Reports: 12:30 pm GMT

- EIA Crude Oil Inventories: 2:30 pm GMT

- RBNZ Gov. Orr Speeches: 6:00 pm and 7:30 pm GMT

- New Zealand Food Price Index: 10:45 pm GMT

- Japan Preliminary GDP: 11:50 pm GMT

- Melbourne Institute Inflation Expectations: 1:00 am GMT (August 15)

- Australia Jobs Data: 1:30 am GMT (August 15)

Today's European data reports will be significant, with the U.K. and France releasing their latest inflation figures. The Euro Area will provide its preliminary GDP readings and quarterly labor market statistics. Later, the U.S. will release its inflation data, which could further impact Fed rate cut expectations. Keep an eye on USD pairs and overall market sentiment when these reports are released!