The markets eased off their recession concerns, resulting in gains for many major assets on Thursday.

Here’s a look at the headlines that contributed to the positive market sentiment yesterday:

Headlines:

- RICS Report: U.K. house price increases fell to -19% in July, a deeper decline compared to June’s -17%.

- Japan Bank Lending Rate: Held steady at 3.2% year-on-year in July, as anticipated.

- BOJ Opinions Summary: Indicated discussions about potential rate hikes and a more hawkish stance from the central bank.

- Japan Current Account Surplus: Dropped from 2.41 trillion JPY to 1.78 trillion JPY in June, falling short of the expected 2.34 trillion JPY surplus.

- RBA Speech: Governor Bullock stated that the central bank is prepared to raise rates if necessary.

- Kiwi Strength: The New Zealand dollar gained following a positive quarterly jobs report.

- Japan Economy Watchers Sentiment: Improved from 47.0 to 47.5 in July.

- U.S. Jobless Claims: Decreased from 250K to 233K (241K expected) for the week ending August 3.

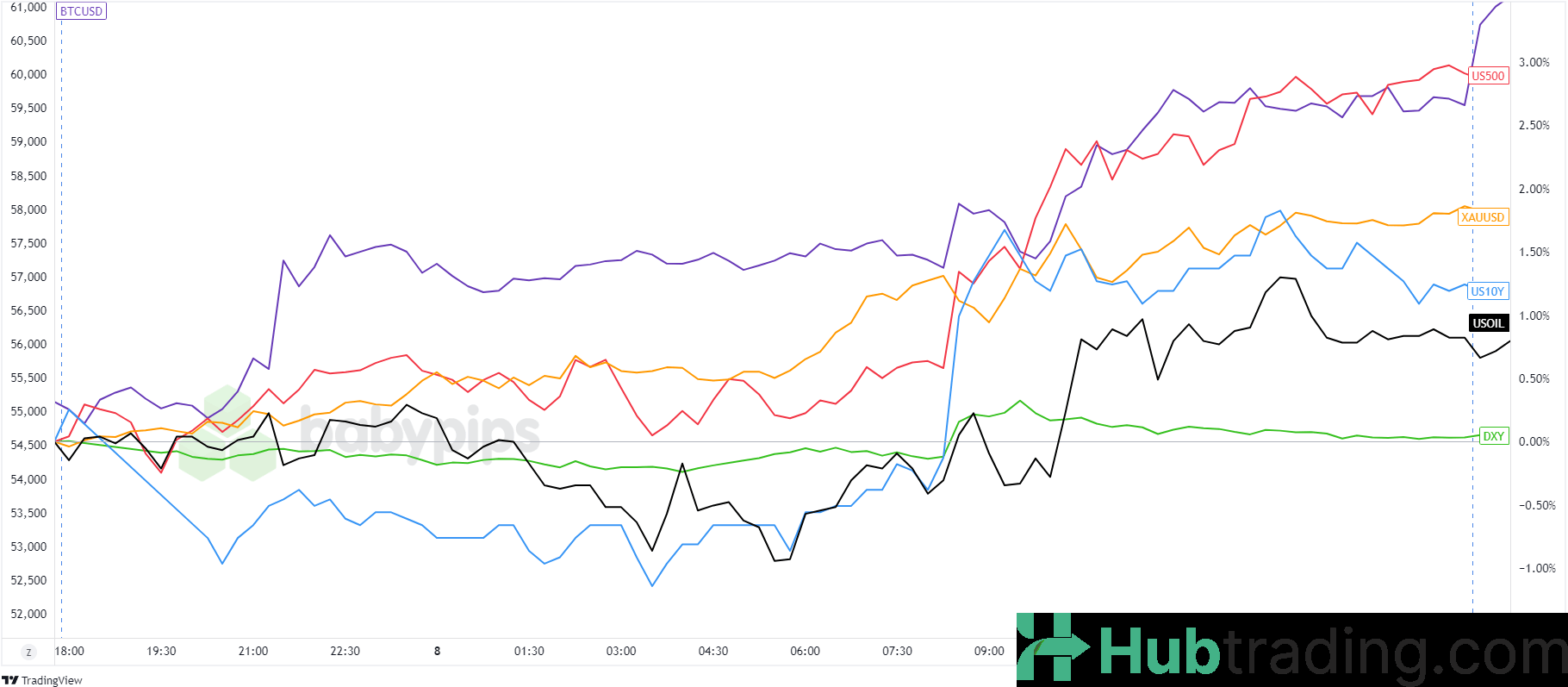

Broad Market Price Action:

Bitcoin (BTC/USD) saw considerable volatility, breaking through the $56,000 support level and initiating an intraday rally that brought it close to $63,000 by the day’s end. At the same time, WTI oil prices had a strong performance, finding support around $74.75 during the European session—likely driven by increasing concerns over geopolitical tensions in the Middle East.

The sentiment turned more optimistic during the U.S. session, following a positive weekly jobless claims report that revealed a drop of 17,000 claims from the previous week. This report underscored the robustness of the U.S. labor market, prompting some traders to shift their outlook from fears of a severe recession to expectations of a more moderate slowdown.

This positive labor market data contributed to a rise in U.S. 10-year Treasury yields and provided a boost to U.S. stocks. The S&P 500 reached new weekly highs, marking its strongest performance since November 2022, while U.S. 10-year yields increased from 3.89% to 4.02%.

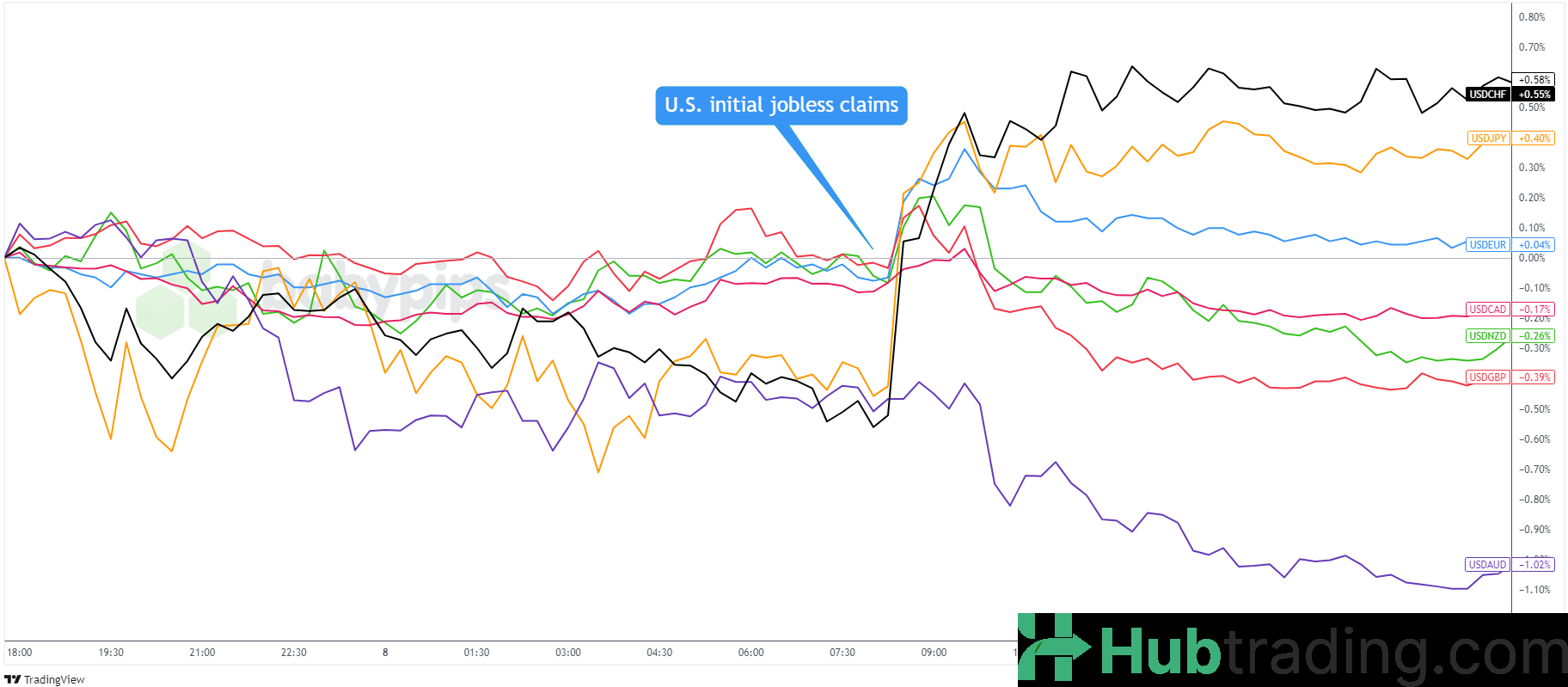

FX Market Behavior: U.S. Dollar vs. Majors:

The U.S. dollar started the day unevenly, influenced by JPY-related volatility following the Bank of Japan’s hawkish Opinions Summary.

The dollar also weakened against the AUD after Reserve Bank of Australia (RBA) Governor Bullock resisted calls for rate cuts, noting that inflation is not expected to return to the target range until late 2025. She also underscored that the RBA is prepared to raise rates if needed.

The Greenback remained relatively stable until the U.S. session began with the release of the initial jobless claims report. The report, which indicated continued strength in the U.S. labor market, helped the dollar recover some ground against safe-haven currencies like CHF and JPY. However, the subsequent risk-on environment led to the dollar’s decline against more risk-sensitive currencies such as AUD, NZD, CAD, and GBP.