With U.S. stock markets closed for the day, market participants shifted focus to shifts in sentiment, the Challenger jobs report, and insights from Federal Reserve commentary.

Risk assets experienced a mixed performance. Commodities such as gold and crude oil posted strong gains, while Bitcoin extended its decline, slipping further below the $100K threshold.

Here’s a closer look at the latest market developments!

Key Headlines:

- Japan: Cash earnings surged 3.0% y/y in November, marking the fastest growth in 32 years (forecast: 2.7%, previous: 2.2%).

- Australia:

- Retail sales increased by 0.8% m/m in November (forecast: 1.0%, previous: 0.5%).

- Goods trade surplus expanded to 7.08B AUD (forecast: 5.62B AUD, previous: 5.67B AUD).

- China:

- Inflation rate YoY in December at 0.1% (forecast: 0.2%, previous: 0.2%).

- PPI YoY in December at -2.3% (forecast: -2.4%, previous: -2.5%).

- Germany:

- Industrial production rose 1.5% m/m in November (forecast: 0.5%, previous: -0.4%).

- Trade surplus climbed to 19.7B EUR (forecast: 14.7B EUR, previous: 13.4B EUR).

- Eurozone: Retail sales increased by 0.1% m/m in November (forecast: 0.3%, previous: -0.3%).

- Switzerland: Foreign currency reserves grew to 731B CHF in December (previous: 725B CHF).

- U.S.:

- Challenger job cuts in December showed an 11.4% y/y increase (previous: 26.8%).

- Federal Reserve officials emphasized a gradual, data-driven approach to easing monetary policy:

- Fed official Collins referred to the December rate cut as labor market insurance.

- Fed official Harker suggested a potential pause in rate cuts due to lingering uncertainties.

- Fed official Schmid noted rates are nearing long-term targets and mandates.

- Fed official Bowman considered December’s cut as a final recalibration step.

Broad Market Price Action:

Market activity was subdued with U.S. stock markets closed for a national day of mourning honoring former President Jimmy Carter.

- Crude oil reversed early losses and gained 1.07% as the session progressed.

- Gold rose 0.27%, benefiting from safe-haven flows amid trade uncertainties, despite a stronger U.S. dollar.

- Bitcoin extended its decline, dropping over $3,000 to hover above $91,000.

- Treasury yields found support after the Challenger job cuts report and upbeat Fed remarks.

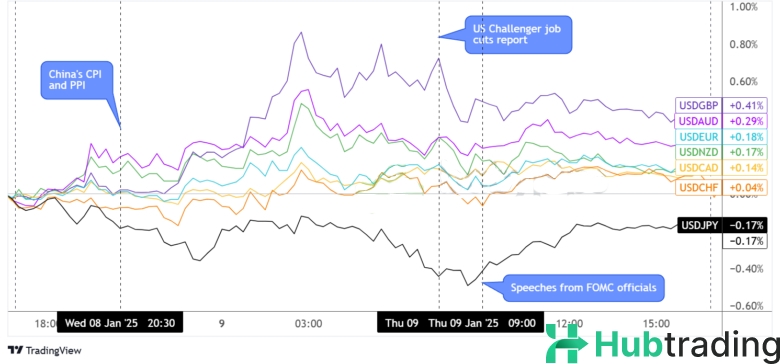

FX Market Overview:

The U.S. dollar held firm against most major currencies, except the stronger Japanese yen, as safe-haven demand and positive data provided support.

- JPY: Strengthened on safe-haven flows due to global trade and geopolitical tensions.

- GBP: Weakened amid rising U.K. gilt yields and concerns over government fiscal policies.

- AUD/NZD: Softened, weighed down by underwhelming Australian data and RBA rate cut discussions, coupled with risk-off sentiment from China’s deflation concerns.

Fed officials’ relatively hawkish tone suggested proximity to inflation targets while reiterating gradual easing, boosting dollar strength.

Upcoming Economic Catalysts:

- 6:45 am GMT: Swiss jobless rate

- 7:00 am GMT: French consumer spending and industrial production

- 12:30 pm GMT: Canada’s employment report and U.S. non-farm payrolls (NFP)

- 2:00 pm GMT: U.S. preliminary UoM consumer sentiment index

The U.S. dollar’s momentum may hinge on December’s NFP report. Strong employment data could reinforce the Fed’s optimistic stance. Meanwhile, Canadian employment figures could drive volatility among Loonie pairs, influencing the Bank of Canada’s policy direction.