U.S. and Canadian banks were closed for the holiday, but that didn’t stop certain asset classes like crude oil and bitcoin from experiencing significant volatility.

Here’s what’s moving the markets so far.

Headlines:

- China's National People’s Congress Standing Committee approved a 10 trillion yuan ($1.4 trillion) plan to help local governments address "hidden" debts, announced after market close on Friday.

- China's October CPI grew by 0.3% year-on-year, marking its slowest increase in four months (0.4% expected, 0.4% previous).

- China’s October PPI dropped 2.9% year-on-year, exceeding expectations of a 2.5% decline (previously -2.8%).

- The Bank of Japan's Summary of Deliberations highlighted the need for caution in raising interest rates, without providing clear guidance on its December policy decision.

- Japan's current account surplus narrowed from 3.15 trillion JPY to 1.27 trillion JPY, below the 2.80 trillion JPY forecast.

- New Zealand’s Q3 2024 quarterly inflation expectations rose slightly from 2.03% to 2.12%.

- China’s new loans in October slowed significantly to 500 billion CNY, well below the expected 770 billion CNY (previously 1.59 trillion CNY).

- Japan’s Economy Watchers sentiment index fell to 47.5 in October, slightly below the forecast of 47.2 (previously 47.8).

- French, Canadian, and U.S. banks were closed for their respective national holidays.

Broad Market Price Action:

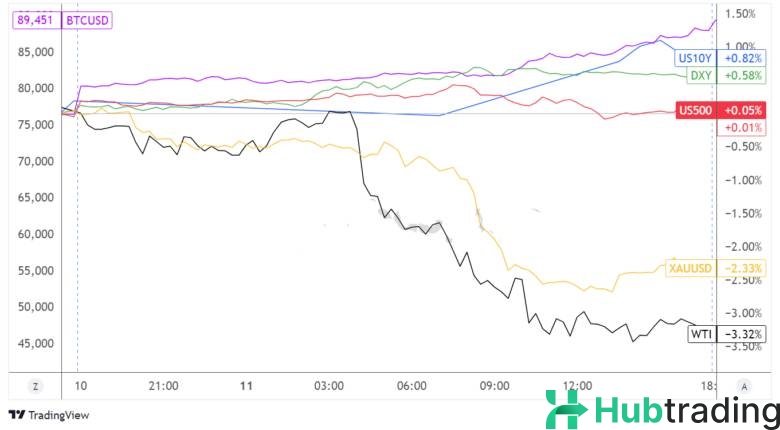

Commodities faced a tough Monday, with gold and crude oil both suffering notable losses. Gold dropped over 2% on the day, while oil saw a decline of more than 3%, likely in response to disappointing Chinese inflation data released over the weekend and ongoing frustration in the markets over China’s stimulus efforts.

Meanwhile, Bitcoin bulls were in full swing, as BTC/USD surged to new all-time highs, breaking past the $89,000 mark, driven by expectations of crypto-friendly regulations under a potential Trump administration.

U.S. bond markets were closed for Veterans Day, but 10-year Treasury yields remained elevated, and the S&P 500 index ended the day nearly flat.

FX Market Behavior: U.S. Dollar vs. Majors:

Monday's data flow was light, with only mid-tier reports such as New Zealand’s quarterly inflation expectations and China’s new loans data in focus. This led to a relatively subdued start to the day, followed by a rally in the U.S. Dollar during the London session.

The Japanese yen weakened significantly against the dollar, following the release of the Bank of Japan's policy meeting minutes over the weekend, which showed officials adopting a cautious stance on tightening and offering no clear guidance on a potential December rate hike.

The euro also faced pressure, primarily due to ongoing political uncertainty in Germany, compounded by concerns over trade tensions with the U.S. under Trump’s presidency.

Upcoming Potential Catalysts on the Economic Calendar:

- Japan’s preliminary machine tool orders at 6:00 am GMT

- U.K. claimant count, jobless rate, and average earnings index at 7:00 am GMT

- BOE MPC member Huw Pill’s speech at 9:00 am GMT

- German and Eurozone ZEW economic sentiment indices at 10:00 am GMT

- FOMC member Waller’s speech at 3:00 pm GMT

- FOMC member Barkin’s speech at 3:15 pm GMT

- FOMC member Kashkari’s speech at 7:00 pm GMT

- FOMC member Harker’s speech at 10:00 pm GMT

- Japan’s PPI report at 11:50 pm GMT

Expect potential sterling volatility later today as the U.K. prepares to release its latest employment data, which could influence the Bank of England’s policy outlook. After that, attention will likely shift back to the U.S. dollar, with several FOMC officials set to speak, potentially offering clues about future central bank moves.

For those looking to trade, check out our HubTrading to stay ahead of the market trends!