- Ethereum’s revenue in September was nearly four times higher than Solana’s following the Federal Reserve’s rate cut.

- The annual inflation rate for Ethereum has surged to a two-year peak of 0.74%.

- Ethereum has regained the $2,395 support level and may rally to $2,595 if it surpasses the 100-day simple moving average (SMA).

Ethereum (ETH) surged over 3% on Friday, with recent reports highlighting a rise in its on-chain revenue for September, even as the annual ETH inflation rate hit a two-year high.

Ethereum’s monthly revenue is showing signs of recovery, despite a growing issuance rate.

According to a report from Swiss crypto bank Sygnum on Thursday, Ethereum’s revenue in September was 3-4 times higher than Solana’s.

The leading blockchain by total value locked (TVL) has seen its revenue share steadily decline since the March Dencun upgrade, which resulted in some of Ethereum’s activity being absorbed by its Layer 2 solutions.

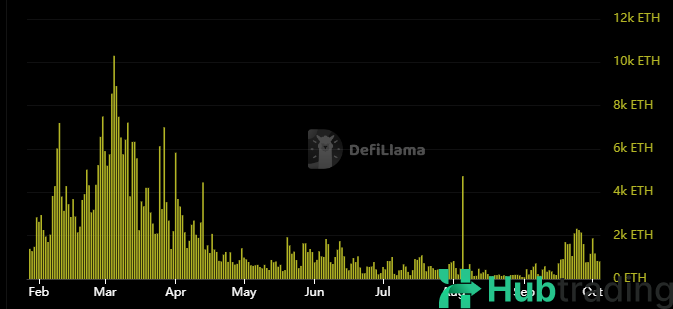

After a dip in on-chain activity following August’s market crash, Ethereum’s revenue hit a multi-year low. However, data from DefiLlama reveals revenue started climbing again after the U.S. Federal Reserve cut rates by 50 basis points.

Ethereum Revenue (Source: DefiLlama)

If market activity continues to grow, Sygnum highlights that Layer 2 (L2) solutions could ultimately benefit Ethereum in the long term.

“While L2 protocols can divert activity from the Ethereum blockchain, these cost-effective, scalable networks also facilitate transactions that were previously uneconomical. Since L2s settle their final states on the main Ethereum chain, this is expected to drive transaction and revenue growth over time,” the bank concluded.

Ethereum co-founder Vitalik Buterin has echoed similar views, suggesting that Layer 1 could compensate for reduced fees through significant scalability in the future.

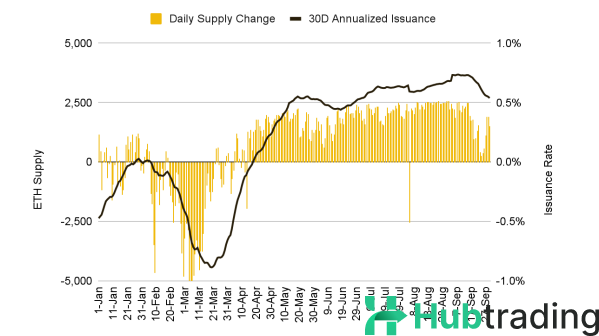

However, in the short term, investors may have concerns as Ethereum’s annual inflation rate has risen to 0.74%, according to Binance Research’s October 2024 Monthly Market Insights report. Binance analysts pointed out that Ethereum’s issuance is at a two-year high, with market share shifting to L2s and lower on-chain activity reducing gas fees, which has slowed the burn rate.

ETH Supply/Daily Issuance (Source: Binance Research)

Ethereum ETFs saw $3.2 million in outflows on Thursday, according to data from Farside Investors.

Ethereum Could Climb to $2,595 After Reclaiming Key Support Level

As of Friday, Ethereum is trading at around $2,430, up 3% for the day. Over the past 24 hours, ETH experienced $20.9 million in liquidations, with long liquidations amounting to $9.04 million and short liquidations reaching $11.86 million, according to Coinglass data.

On the 4-hour chart, ETH has reclaimed the $2,395 level after finding support near a key descending trendline. The price appears to have been defended by investors who purchased 52.3 million ETH in the $2,316 to $2,385 range, identified as the highest demand zone, according to IntoTheBlock’s data.

ETH/USDT 4-Hour Chart

ETH has the potential to climb to $2,595 if it maintains its bullish momentum and breaks above the 100-day Simple Moving Average (SMA).

The Relative Strength Index (RSI) is nearing its neutral level, while the Stochastic Oscillator (Stoch) is trending towards the oversold zone.

However, a daily candlestick close below $2,395 would invalidate this bullish outlook.