- EUR/CAD is trading near the midpoint of a multi-week range, with both currencies affected by similar negative fundamentals.

- Both the Bank of Canada and the European Central Bank are anticipated to cut rates by the end of 2024, creating headwinds for the Euro (EUR) and Canadian Dollar (CAD).

- Additionally, the CAD is under pressure due to risks associated with the US elections and declining crude oil prices.

EUR/CAD continues to exhibit range-bound trading on Friday, hovering around 1.5000 after a slight upward movement. The pair remains firmly entrenched in an 11-week range, lacking direction due to the similar monetary policy outlooks of the European Central Bank (ECB) and the Bank of Canada (BoC).

Both central banks are currently in the process of cutting interest rates as inflationary pressures from the Covid-19 crisis begin to subside. The relative interest rate levels set by these institutions significantly influence exchange rates, as capital tends to flow toward currencies offering higher returns. Consequently, neither the CAD nor the EUR is showing strong performance, given the expected aggressive rate cuts from both central banks.

EUR/CAD 4-hour Chart

In its recent October meeting, the BoC surprised markets by lowering its official interest rate by 50 basis points (bps) to 3.75%, down from 4.25%. Many analysts had anticipated a more cautious 25 bps reduction. This unexpected move had a negative impact on the CAD, which weakened against most currencies, although the effect was muted against the EUR, resulting in a marginal gain for EUR/CAD.

The limited decline of the CAD against the EUR was partly due to a Reuters report suggesting the ECB was considering cutting interest rates below the “neutral” rate, estimated to be between 1.5% and 2.0%. With the ECB’s key rate currently at 3.40%, this indicates the potential for significant cuts ahead.

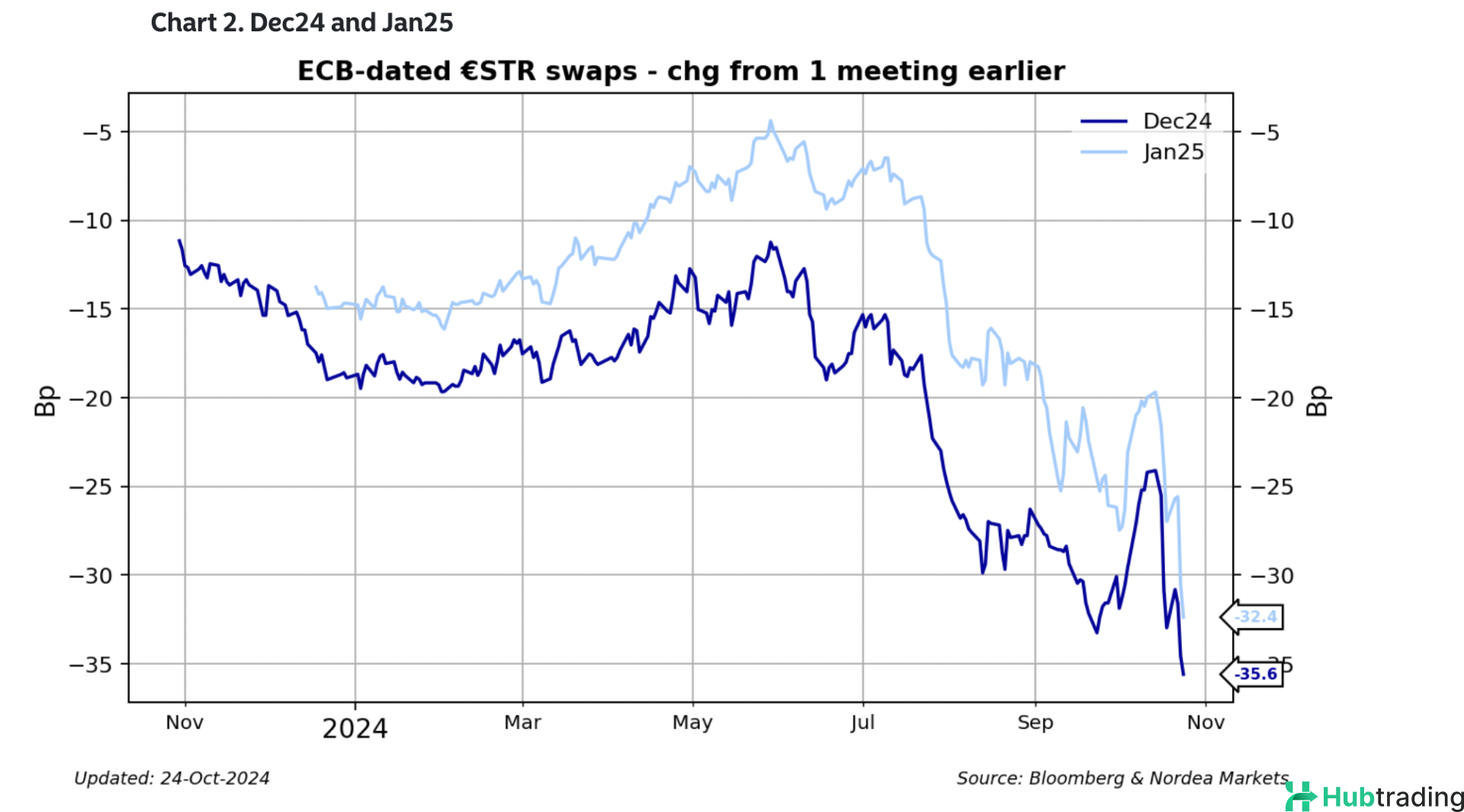

The report heightened speculation that the ECB might implement a more aggressive rate cut at its final meeting of the year in December. Swap rates are pricing in an increasing likelihood of a 50 bps reduction. “Rates are falling significantly as markets are pricing a higher probability of the ECB going for a 50 bps rate cut in December,” noted Andres Larsson, Senior FX Analyst at Nordea Bank, who also mentioned the market’s expectation for rates to eventually dip below neutral.

Recent Eurozone data did little to alleviate these concerns. The October Purchasing Manager Indexes (PMIs) indicated that while manufacturing activity rose, it remained in contraction territory at 45.9. The Services PMI dipped to 51.2 from 51.4 in September. “Today’s PMIs were more or less in line with expectations, although the employment component dropped below 50, suggesting rising unemployment risks,” said Larsson.

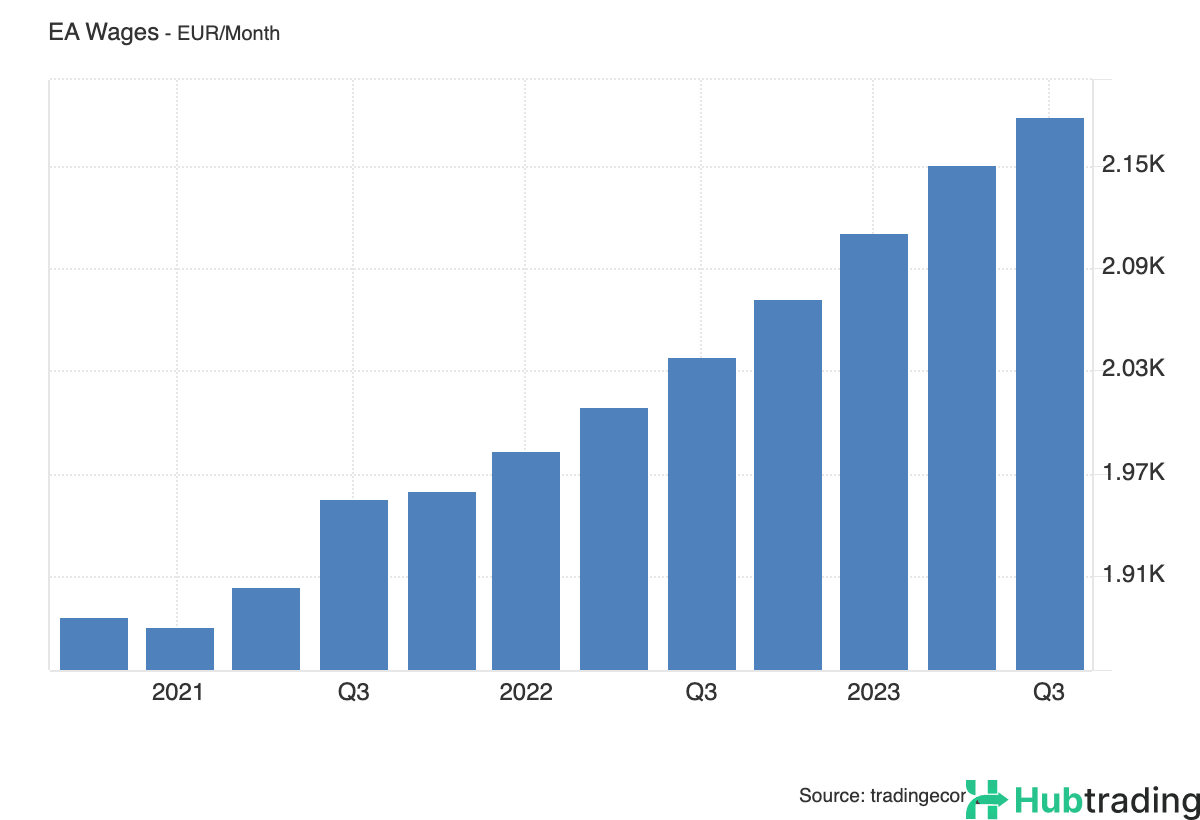

The ECB’s Chief Economist, Martin Lane, indicated that wage inflation might stay elevated into the latter half of 2024, which could complicate significant rate cuts before 2025. Should this be the case, the ECB may opt for a more conservative 25 bps cut in December, potentially benefiting EUR/CAD.

Official data showed Eurozone wages rose 4.5% in Q2, down from 5.2% in the previous quarter, but still high. The Eurozone’s Average Monthly Wage reached EUR 2,180 in September, indicating ongoing upward wage pressures.

On Friday, the German IFO Business Climate Index reported a higher-than-expected reading, which may have bolstered sentiment around the German economy—traditionally the Eurozone’s economic powerhouse. The index rebounded to 86.5 in October from 85.4 in September, surpassing the anticipated 85.6.

In contrast, Canadian consumer spending data showed a modest increase of only 0.4% month-over-month in August, down from 0.9% in July and below the estimated 0.5%. This could further weigh on the CAD.

Additionally, the CAD faces pressure from the prospect of Donald Trump winning the upcoming US presidential election, along with falling crude oil prices—Canada’s primary export. Trump’s potential presidency raises concerns about tariffs on Canadian imports, which could diminish demand for the CAD. Although current polls show Vice President Kamala Harris leading with 48.1% compared to Trump’s 46.4%, betting odds favor Trump.

Recent polling indicates a competitive landscape in battleground states, with Trump marginally leading in critical areas like Pennsylvania and Wisconsin. Jim Reid, Global Head of Macro Research at Deutsche Bank, noted that polls in these states remain tight and within the margin of error.