Net Risk-on Scenario: AUD/NZD

![]()

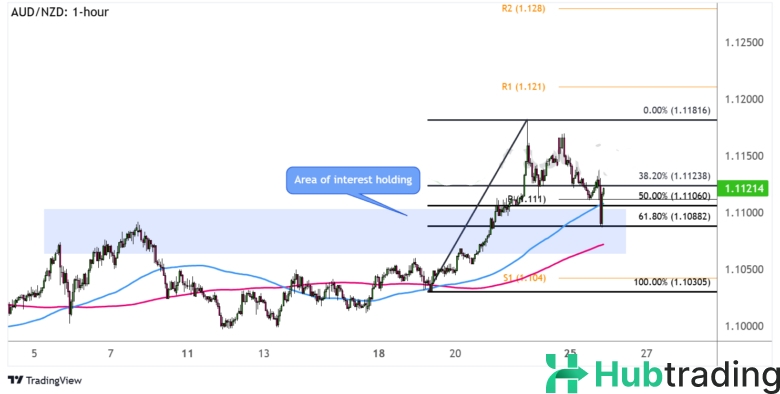

The hawkish RBA meeting minutes last week provided a boost to the Australian dollar, allowing it to break through the key 1.1100 level against the Kiwi, reaching a swing high of 1.1182. Despite a pullback due to risk-off flows from geopolitical tensions, the Aussie could maintain its strength, particularly if Australia's CPI data continues to show persistent inflation.

This would reinforce the RBA’s stance on keeping rates higher for longer, while contrasting with the RBNZ's likely continued rate cuts. Watch for further support around the 61.8% Fibonacci level, which could push AUD/NZD towards the swing high or the next targets at R1 (1.1210) and R2 (1.1280). The 100 SMA above the 200 SMA indicates growing bullish momentum.

Net Risk-off Scenario: NZD/JPY

![]()

With ongoing trade war concerns and rising tensions between Russia and Ukraine, risk-off flows may favor the Japanese yen. Meanwhile, Japan’s central bank is expected to raise rates in December, creating a divergence with the dovish RBNZ. NZD/JPY has already broken through its support around 90.50, but a pullback could happen if volatility increases ahead of the RBNZ decision.

A "buy the rumor, sell the news" reaction to the anticipated 0.50% RBNZ rate cut could lead to a short-term Kiwi rally, but longer-term trends may prevail. Look for reversal signals around key Fibonacci retracement levels (50%–61.8%) near former support, dynamic resistance from SMAs, and a falling trendline.

Regardless of the trade setup, ensure proper risk management and stay alert to key market drivers that could shift sentiment.