- Gold faces uncertainty as the Trump administration eases tariff pressure on Mexico and Canada.

- US yields see a slight recovery, while Fed’s Waller anticipates the possibility of two or even three rate cuts this year.

- Traders prepare for the February Nonfarm Payrolls report, set for release this Friday.

Gold’s price (XAU/USD) edges higher, extending its consolidation streak for the third consecutive day this week. The recent rally in bullion has stalled after U.S. President Donald Trump exempted all goods from Mexico and Canada covered under the USMCA trade agreement from newly imposed tariffs earlier this week. Meanwhile, U.S. equity markets continue to trade below levels seen on Trump’s inauguration day.

On the rates front, traders found some reassurance in comments from Federal Reserve (Fed) official Christopher Waller. Speaking on Thursday, Waller stated he would not support an interest rate cut in March but acknowledged the potential for two or even three rate cuts this year. His remarks align with market expectations, which anticipate June as a key turning point for the Fed’s first rate reduction in 2024.

Market Movers: Crypto and Geopolitical Developments

- U.S.-China Tensions: Geopolitical strains between the world’s two largest economies remain high. Chinese Foreign Minister Wang Yi defended China’s efforts to curb fentanyl exports to the U.S. at a high-profile briefing on Friday, while also accusing President Trump of using the issue as leverage against Beijing, according to Bloomberg.

- Crypto Volatility: Hopes were high in the crypto market after President Trump signed an executive order to establish a strategic Bitcoin reserve. However, Bitcoin plunged below $90,000 after it was revealed that the reserve would only centralize existing tokens rather than purchase new Bitcoin using taxpayer funds, Bloomberg reports.

- Fed’s Interest Rate Outlook: “If the labor market and overall conditions remain stable, we can focus on inflation,” Fed’s Waller said at the Wall Street Journal CFO Network Summit on Thursday. “If inflation moves closer to target, we can start lowering rates—not at the next meeting, but certainly in the near future,” he added, according to Reuters.

- Gold Exports Surge: Australia’s gold shipments to the U.S. surged to a record high in January as traders rushed to New York warehouses to take advantage of extreme price disparities amid tariff concerns. According to the Australian Bureau of Statistics, gold exports to the U.S. totaled A$4.6 billion ($2.9 billion), the highest level since records began in 1995, Bloomberg reports.

Technical Analysis: Gold Holds Steady Amid Rate Cut Bets

Expectations for Fed rate cuts are now gaining traction among policymakers, providing underlying support for gold prices. However, without a fresh catalyst—such as new tariffs or an escalation in trade tensions—a move to fresh all-time highs remains uncertain.

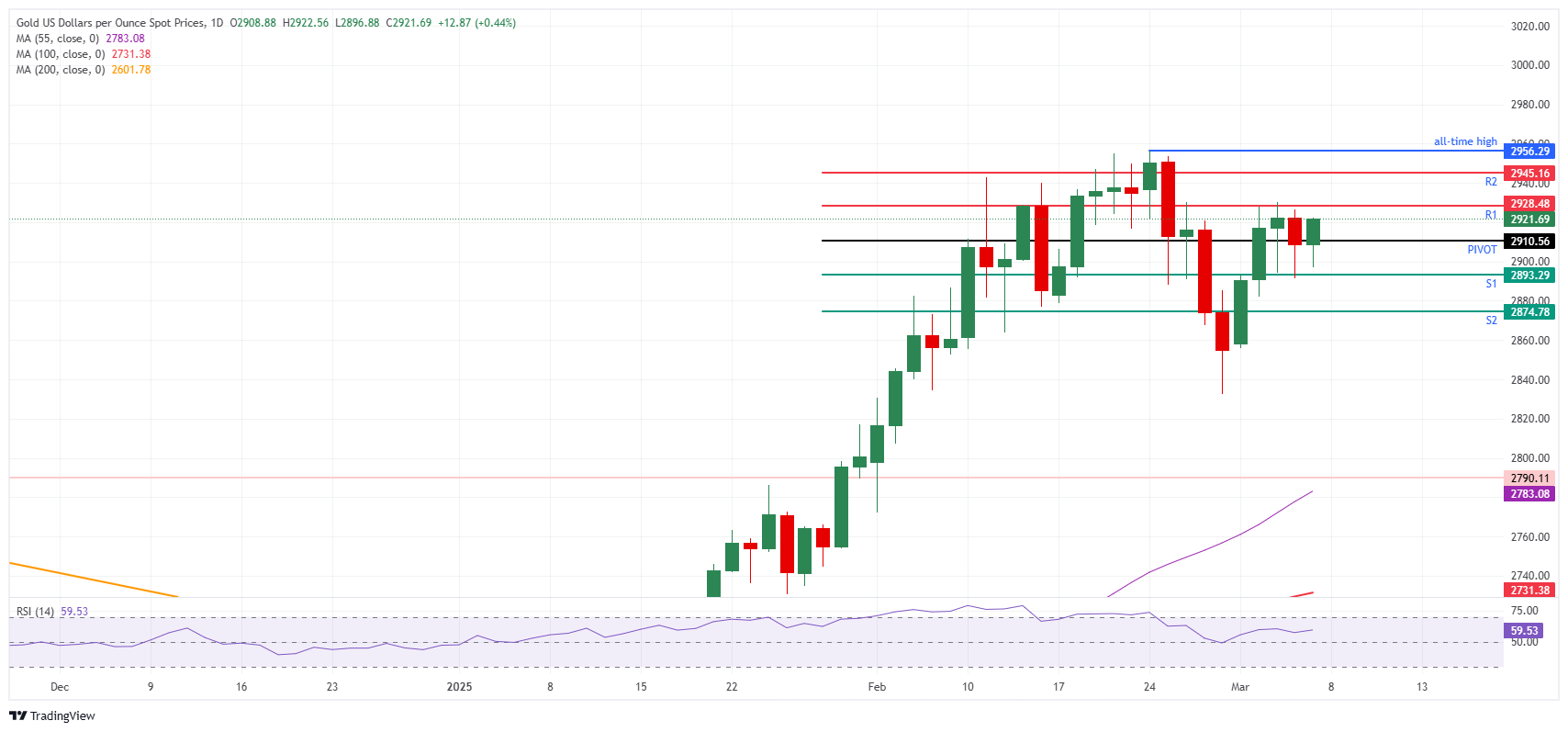

Gold is currently trading near $2,917, with key technical levels to watch for Friday:

- Resistance Levels: The daily Pivot Point at $2,910 and the R1 resistance at $2,928 serve as initial barriers. A stronger rally could push prices toward R2 resistance at $2,945, ahead of the all-time high of $2,956 reached on February 24.

- Support Levels: On the downside, the $2,900 psychological level and S1 support at $2,893 act as a critical support zone. A break below this level could see additional downside pressure, with S2 support at $2,874 providing further protection.

For gold bulls to maintain momentum, the $2,900-$2,893 zone must hold firm to prevent a deeper pullback.