- Gold reaches another all-time high, trading around $2,955 on Thursday.

- President Trump criticizes Ukraine, labeling it a dictatorship responsible for the war.

- Declining US yields may fuel further gains, pushing Gold to new record highs.

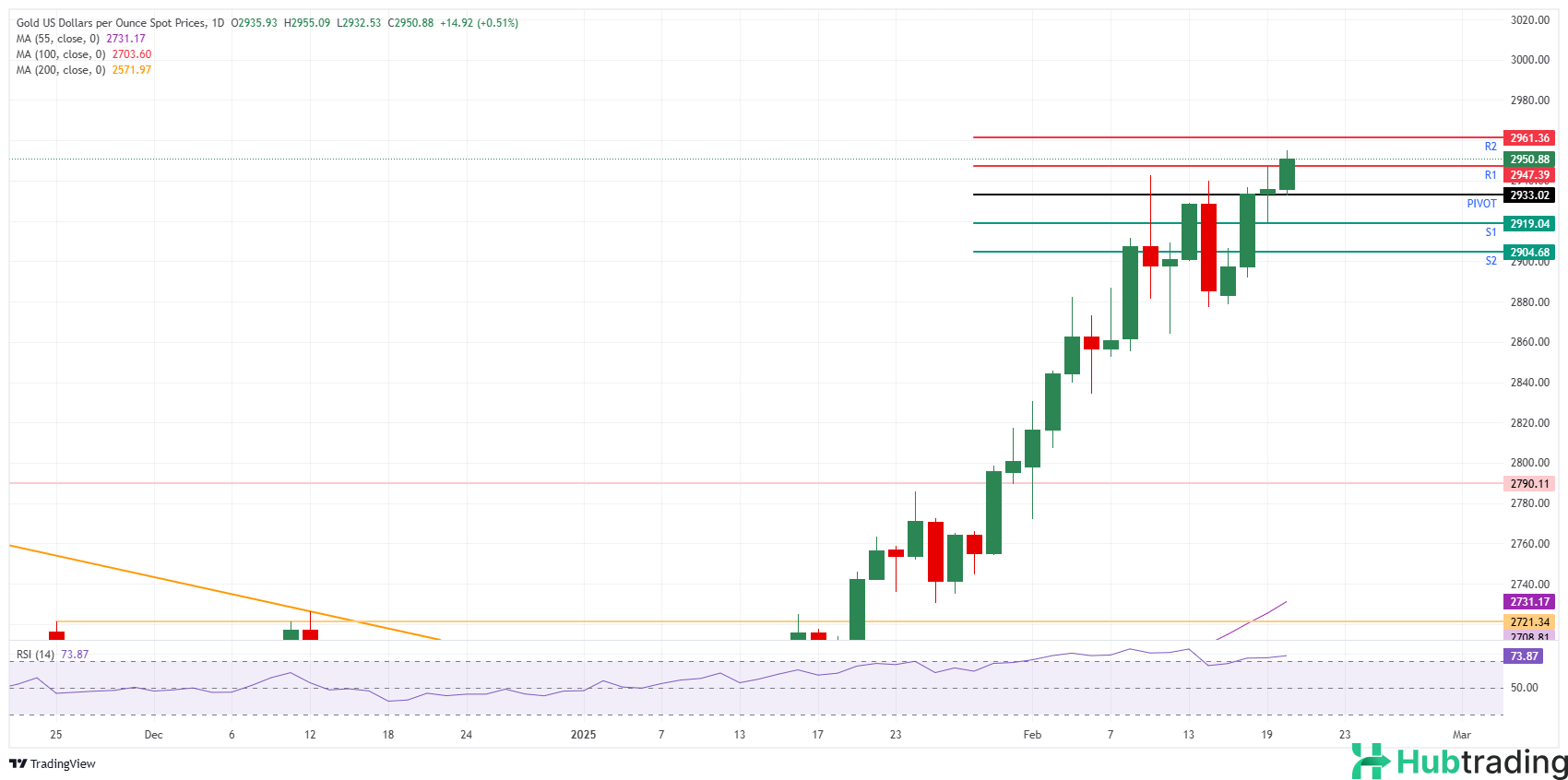

Gold (XAU/USD) hovers near another fresh all-time high, trading around $2,955 after an earlier surge on Thursday. The latest rally follows US President Donald Trump’s comments suggesting a potential trade deal with China while simultaneously escalating geopolitical tensions by blaming Ukraine for starting the war with Russia and hinting at repayment expectations for US financial aid.

Meanwhile, the Federal Reserve (Fed) Minutes from the January meeting had minimal market impact, with only a few FOMC members advocating for steady interest rates and no urgency for cuts, keeping June rate cut expectations intact.

Daily Market Movers: Pressure Builds on Gold

- Physical Gold Transfers: Thousands of gold bars are being moved from the Bank of England’s vaults to the US futures market, exposing logistical bottlenecks. This shift is driven by arbitrage opportunities amid speculation that Trump may impose tariffs on Gold, leading traders to buy spot Gold in London and sell futures contracts in the US (Bloomberg).

- Gold Fields Ltd. Profit Surge: The South African miner reported a 77% increase in full-year profit, driven by soaring Gold prices and operational improvements in Chile and South Africa (Reuters).

- US-Ukraine Relations Deteriorate: Tensions escalated after Trump clashed with Ukrainian President Volodymyr Zelenskiy on social media. Trump warned that Ukraine must move quickly to negotiate a deal with Russia, or risk losing its country (Bloomberg).

Technical Analysis: Can Anything Stop Gold’s Rally?

Despite Trump’s softer stance on tariffs and hints of a US-China trade deal, Gold’s momentum remains strong, with $3,000 in sight. However, market frenzy could signal a selling opportunity when it reaches mainstream investors.

-

Support Levels:

- $2,947 – Pivot Point’s R1 resistance and Wednesday’s high

- $2,933 – Daily Pivot Point

- $2,919 – S1 support, aligning with Wednesday’s low

-

Resistance Levels:

- $2,961 – R2 resistance, expected to be tested later today

- $3,000 – Psychological level, possibly out of reach this week

With a light economic calendar, Gold remains positioned for further gains, as market sentiment and geopolitical risks continue to drive demand.