- Gold hovers near $2,900 on Thursday as trade tensions ease slightly.

- The postponement of US auto tariffs on Mexico and Canada has impacted Treasury yields.

- Traders anticipate multiple Fed rate cuts amid weakening US economic data.

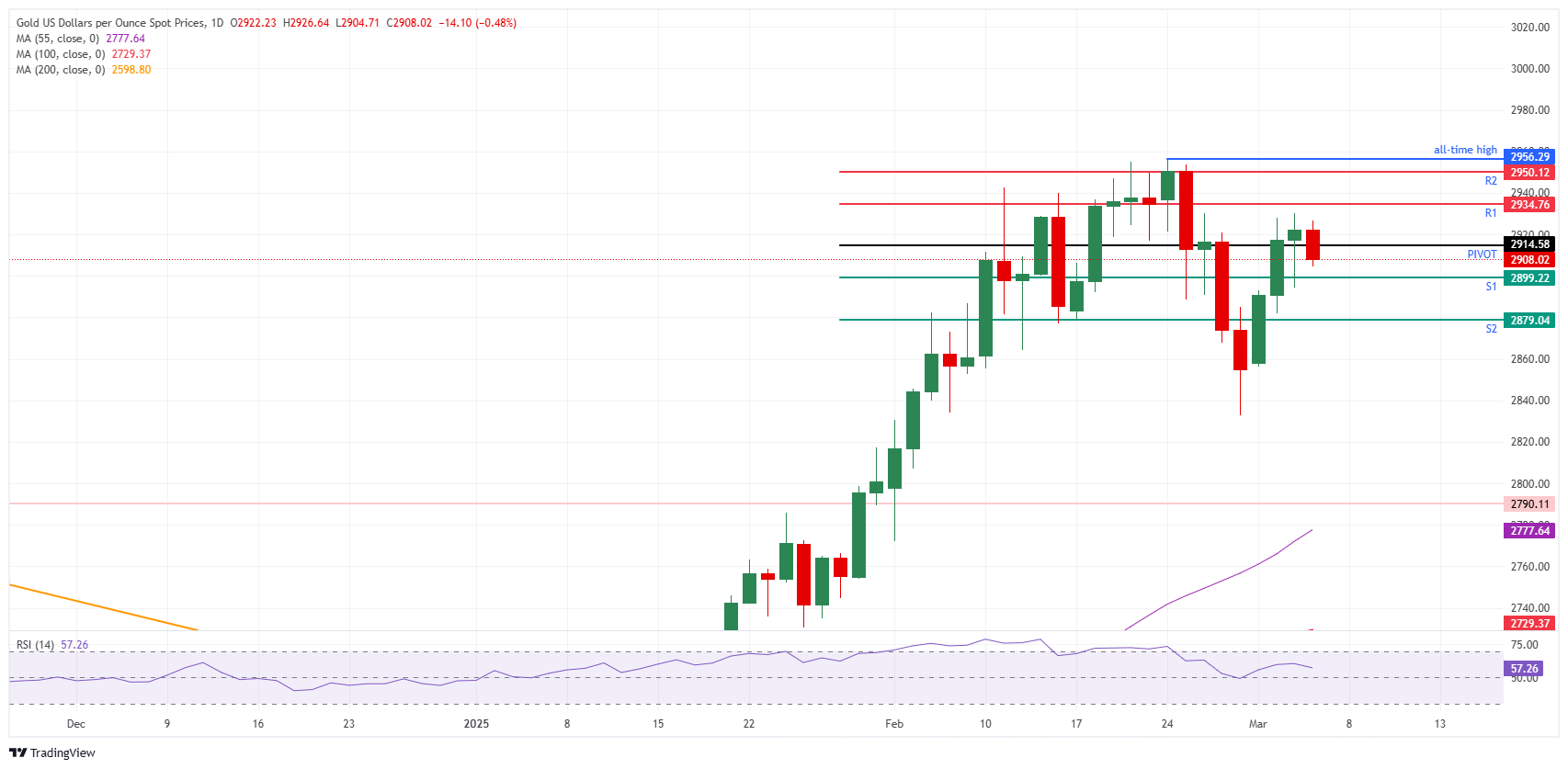

Gold (XAU/USD) edges slightly lower to around $2,900 on Thursday, though a push toward a new all-time high above $2,956 remains possible. While the delay in US auto tariffs on Mexico and Canada provides some relief, reciprocal tariffs are still set to take effect in April, maintaining demand for safe-haven assets like gold.

Market attention now shifts to Europe, where the European Central Bank (ECB) is expected to announce a 25 basis point (bps) rate cut. Additionally, EU leaders will convene for a high-stakes meeting to discuss defense spending and potential additional aid to Ukraine.

Shifting bond market dynamics also influence gold prices, as traders increasingly bet on multiple Federal Reserve (Fed) interest rate cuts in 2025 due to weakening US economic data, fueling recession concerns.

Daily Market Movers: Gold and Copper in Focus

- The postponement of US auto tariffs on Mexico and Canada has influenced Treasury yields, reinforcing expectations of multiple Fed rate cuts, which could boost gold prices.

- Copper surged over 5% on Wednesday, with prices rising further after US President Donald Trump suggested imposing a 25% tariff on copper imports.

- In Mali, authorities have halted permits for small-scale gold mining by foreign nationals following a series of deadly incidents, with the government vowing to strengthen safety and environmental measures.

Technical Analysis: Gold Faces Key Support and Resistance Levels

Growing expectations for Fed rate cuts provide tailwinds for gold amid shifting market sentiment. While analysts initially predicted minimal or no cuts, sentiment has rapidly changed, with markets now anticipating at least two reductions this year.

Gold trades near $2,905 at the time of writing, with the daily Pivot Point at $2,914 and resistance at $2,934 being key levels to watch. Further upside could push prices toward $2,950, just below the record high of $2,956 set on February 24.

On the downside, support at $2,899 aligns with the psychological $2,900 level, making it a critical threshold. A break below could see further declines toward $2,879, where additional support is expected.