- Gold saw a slight increase on Friday as US President Trump’s reciprocal tariffs are set to take effect in the coming weeks.

- Traders are turning to gold once again as a safe-haven asset, with the US Dollar weakening significantly.

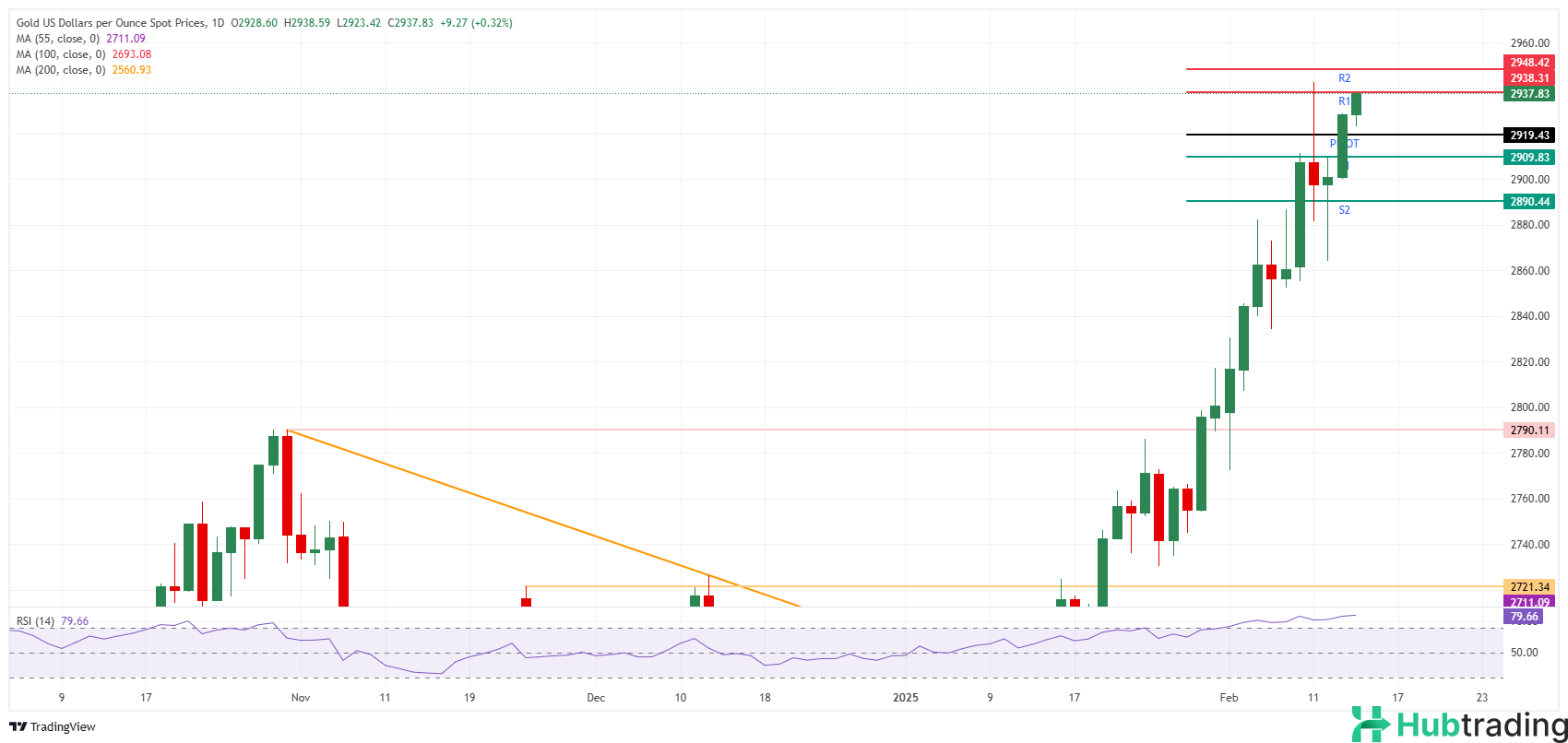

- Gold remains on track to potentially test its all-time high of $2,942 by Friday.

Gold (XAU/USD) is edging higher, currently approaching $2,935 as of Friday, positioning itself for a potential new all-time high and solid gains by the end of the week. The latest upward movement follows US President Donald Trump’s executive order on reciprocal tariffs, signed on Thursday. While it will take weeks before these tariffs are implemented, investors are acting swiftly, seeking safety in Gold amid growing uncertainty.

Gold’s rally received further support from a weakened US Dollar (USD) and a drop in the US Dollar Index (DXY). The Greenback is losing momentum as the tariffs are not set to take effect immediately, leaving room for potential negotiations and reducing the urgency for a flight to safety despite the president’s recent announcements.

Daily Market Movers: What’s Next?

- Gold continues its upward trend for a third consecutive day, nearing record highs after President Trump’s tariffs sparked greater uncertainty around global trade and the economy, according to Bloomberg.

- Bullion futures on Comex are trading at a notable premium to spot prices, with the most active April contract above $2,960, while cash is trading about $30 below its all-time high, reports Reuters.

- At 13:30 GMT, January’s US Retail Sales data will be released, with expectations pointing to a 0.1% decline compared to December’s 0.4% increase.

Technical Analysis: Will it Rebound or Reach New Heights?

Gold is on track to hit a fresh all-time high before the weekend. If the bullish trend persists, it may prove difficult to reverse. However, any positive geopolitical developments could shift the momentum, potentially ending the rally and dampening Gold's rise.

The initial support for Friday is at $2,919 (daily Pivot Point), followed by $2,909 (S1 support). If the decline continues, the $2,890 level (S2 support) could help prevent further drops, with a more significant support at $2,790 (October 31, 2024 high).

On the upside, the first hurdle is $2,938 (R1 resistance), followed by $2,948 (R2 resistance). If the rally extends, the $2,950 mark will be tested, potentially leading to a breakthrough. Beyond that, the psychological $3,000 level could be next.