- Gold gains momentum, surging amid renewed tariff concerns.

- US yields rise as lower inflation sparks a shift toward equities.

- Traders navigate trade war developments and market volatility.

Gold price (XAU/USD) is once again approaching new all-time highs after US Consumer Price Index (CPI) data came in weaker than expected on Wednesday. This eased market concerns over a potential recession or stagflation, leading to a shift in investor sentiment. As a result, funds flowed out of US bonds and into US equities, with the bond sell-off driving yields higher. At the time of writing on Thursday, gold is trading around $2,950.

Meanwhile, geopolitical developments remain in focus. On Wednesday, US President Donald Trump announced that the US will impose reciprocal tariffs on Europe, set to take effect on April 2. At the same time, US diplomats are heading to Russia to negotiate a ceasefire deal, which has already gained support from Ukraine and includes continued US military assistance.

Daily Digest Market Movers: Brief Respite

-

US CPI Data Signals Slower Inflation: The Consumer Price Index (CPI) for February rose at the slowest pace in four months, reinforcing expectations for a quarter-point rate cut by the Federal Reserve in June. Lower borrowing costs typically favor gold, as it does not yield interest (Bloomberg).

-

Gold Set to Surge Past $3,100: BNP Paribas SA forecasts gold to reach a new record above $3,100 in Q2 2025, citing heightened economic uncertainty driven by US President Donald Trump’s tariff policies (Reuters).

-

Inflation Concerns Could Push Gold to $3,500: Macquarie Bank warns that a worsening US budget outlook could fuel inflation, increasing gold's appeal as a hedge. The bank projects gold could hit $3,500 by Q3 2025 (Bloomberg).

-

Fed Rate Outlook: The CME FedWatch Tool indicates a 97% probability that the Federal Reserve will hold rates steady at its March 19 meeting. The likelihood of a rate cut at the May 7 meeting currently stands at 39.5%.

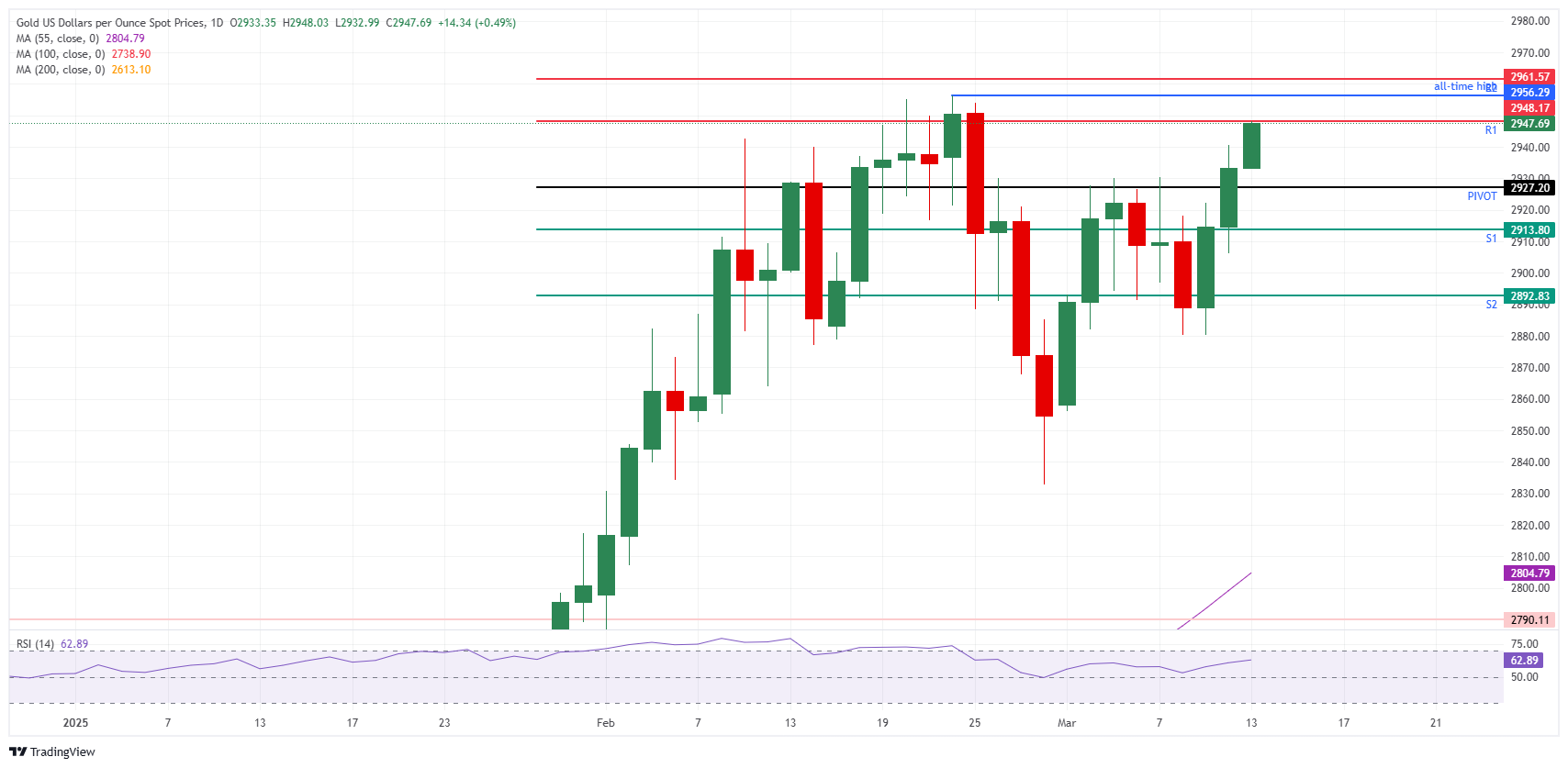

Technical Analysis: Gold Continues to Push Higher

Gold is currently testing the intraday R1 resistance level at $2,947 as of Thursday. This move appears somewhat contradictory, given that US yields surged higher on Wednesday following a softer-than-expected US CPI report. The reason behind this trend lies in the fund flow dynamics—as US bonds experienced an outflow, equities gained momentum, driving yields higher. However, this brief market optimism is already fading, with investors shifting focus back to tariffs, Ukraine, and concerns over a possible US recession or stagflation.

Gold is now eyeing the $2,950 level, aligning closely with the R1 resistance at $2,947. A breakout above this level would shift attention to the intraday R2 resistance at $2,961, surpassing the previous all-time high of $2,956.

On the downside, the daily Pivot Point stands at $2,927. If this level is breached, the next support level (S1) is located around $2,913. Further declines could see gold testing the S2 support at $2,892, though the $2,900 psychological level is expected to act as a strong buffer against deeper corrections.