- Gold remains flat on Monday, trading within a narrow range.

- US yields have edged up from their year-to-date low after President Trump’s remarks on the US economy.

- Traders are positioning ahead of the Federal Reserve meeting on March 19.

Gold prices (XAU/USD) remain in a narrow trading range near the $2,900 level on Monday as the new trading week begins. Investors are digesting comments from U.S. President Donald Trump following his weekend interview on Fox News. When asked about the state of the U.S. economy, Trump described it as being in a "transition" phase, diverging from broader market concerns about a potential recession.

Meanwhile, Federal Reserve (Fed) Chairman Jerome Powell delivered remarks on Friday before the Fed entered its blackout period ahead of the March 19 policy meeting. Powell signaled that the central bank is in no rush to adjust interest rates, emphasizing that keeping rates steady carries minimal risk compared to the potential consequences of premature changes.

Daily Market Movers: Blackout Period Begins

- U.S. President Donald Trump characterized the economy as undergoing a “period of transition,” reinforcing his focus on tariffs and federal job reductions, according to Bloomberg.

- Fed Chair Jerome Powell acknowledged growing economic uncertainties but reaffirmed that the Fed does not need to act swiftly on policy changes. The Atlanta Fed’s GDP model suggests the U.S. economy may contract this quarter, Reuters notes.

- The CME FedWatch Tool indicates a 97.0% probability that the Fed will maintain current interest rates on March 19, with odds of a rate cut by the June 18 meeting rising to 81.8% as of Monday.

Technical Analysis: Market Pullback in Focus

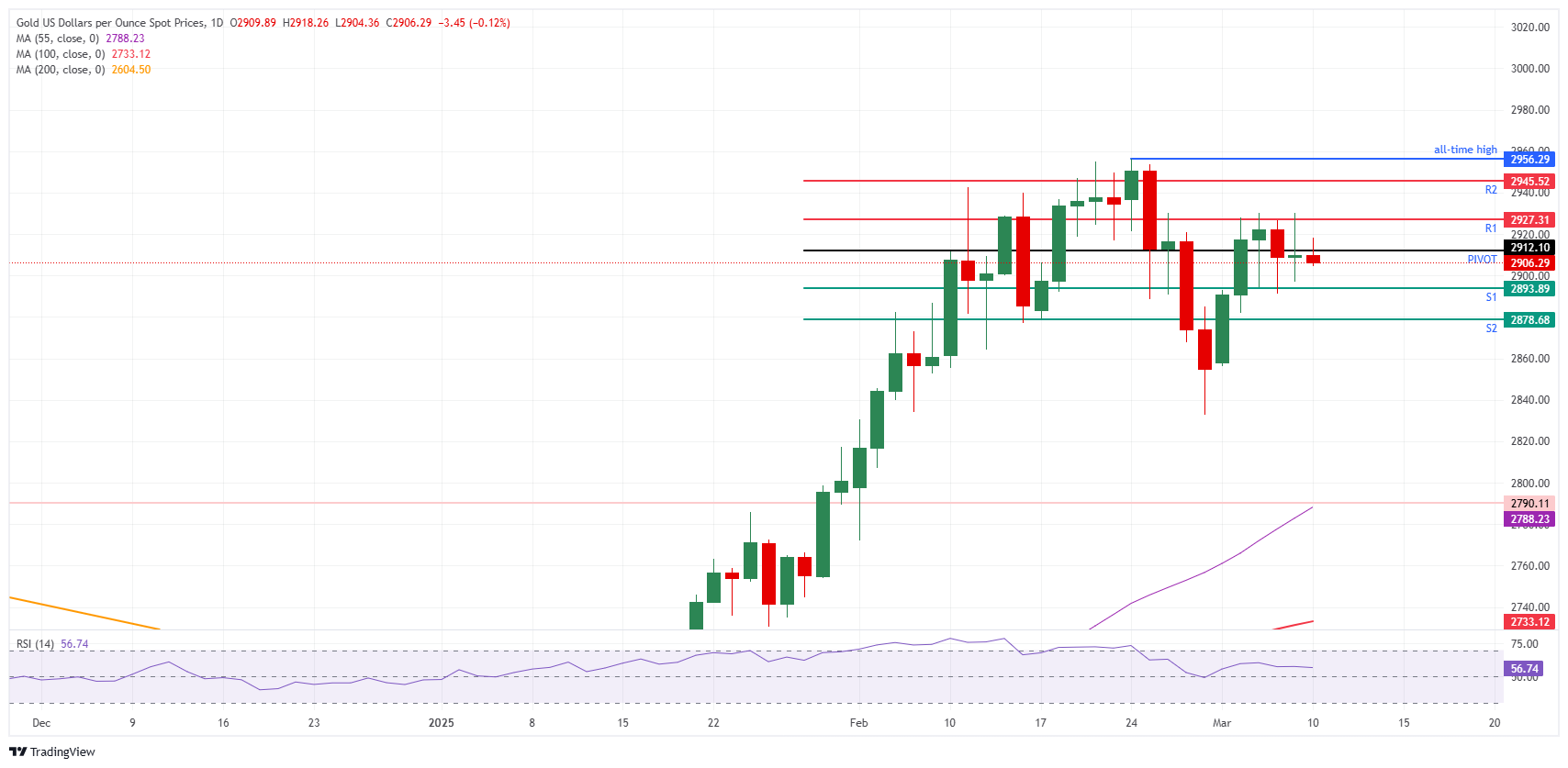

After extended price movements, markets may take a step back for consolidation, and Gold is no exception. The precious metal could see a pullback, especially if President Trump refrains from additional tariff announcements, helping to ease investor nervousness. A dip toward the S2 support at $2,878 could present a buying opportunity before reciprocal tariffs take effect next month.

At the time of writing, Gold is trading near $2,905, with key resistance levels at the daily Pivot Point of $2,912 and the R1 level at $2,927. If further buying momentum emerges, the R2 resistance at $2,945 could act as the final hurdle before challenging the all-time high of $2,956 set on February 24.

On the downside, the $2,900 psychological level and S1 support at $2,893 serve as a critical defense zone for bulls. A break below this region could expose Gold to further declines, with the S2 support at $2,878 acting as the next key threshold against additional downside pressure.