- Gold edges closer to a 1% gain on Tuesday, recovering from early-week losses.

- Reports of a potential German defense spending deal weigh on the US Dollar, boosting Gold.

- Traders remain cautious ahead of the Federal Reserve meeting on March 19.

Gold (XAU/USD) climbs back above the $2,900 psychological level and trades above $2,910 on Tuesday. The surge follows a domino effect triggered by news that Germany’s Green coalition leaders have approved a defense spending deal. This development boosted confidence in the Euro (EUR), weakening the US Dollar Index (DXY) and providing strong support for Gold prices.

Meanwhile, global trade tensions remain high as a tariff war escalates beyond the United States (US). Canada has imposed tariffs on several Chinese imports, prompting retaliatory measures from China, including levies on Canadian goods such as canola oil. US President Donald Trump’s aggressive trade policies are reshaping global markets, with Canada and Mexico potentially facing tariff relief if they impose additional duties on Chinese goods.

Daily Digest Market Movers: Thai Baht Strengthens

- Concerns over a potential US recession grow after President Donald Trump warns that his tariff policies could initially harm the economy. Gold, traditionally seen as a safe-haven asset, may face selling pressure if market turmoil intensifies, Bloomberg reports.

- The Thai Baht (THB) has gained momentum this year, driven by surging Gold prices. However, strategists caution that this rally may not be enough to shield Thailand from broader tariff risks. The THB is up approximately 1.2% against the US Dollar in 2024, outperforming a broader index of Asian currencies. Thailand’s role as a key Gold-trading hub has strengthened investor confidence in its currency.

- The CME FedWatch Tool indicates a 95.0% probability that the Federal Reserve (Fed) will maintain interest rates at the upcoming March 19 meeting. However, the likelihood of a rate cut at the May 7 meeting has risen to 47.8%.

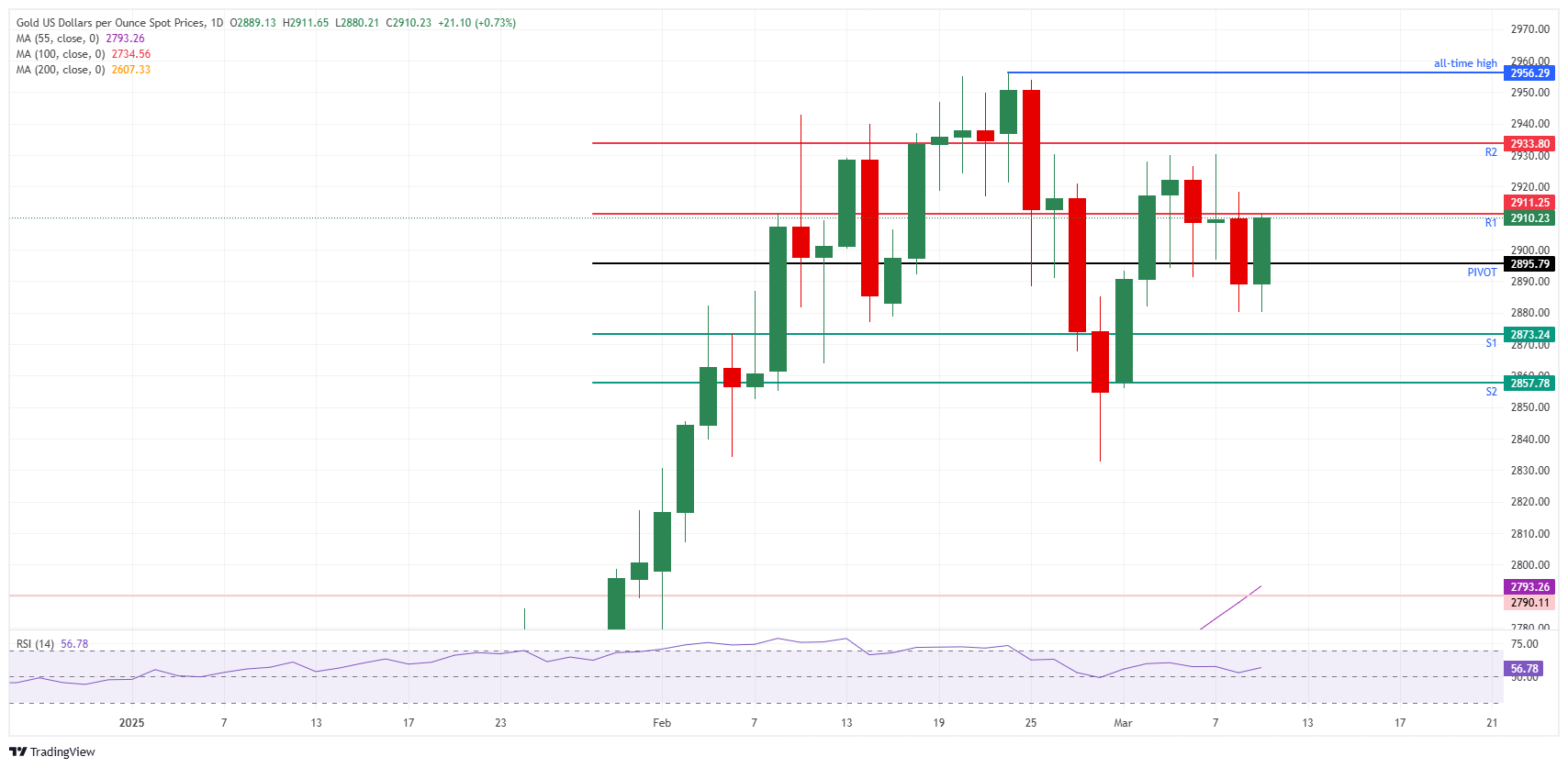

Technical Analysis: Gold Recovers Early Losses

Unlike previous sessions where tariff headlines dictated market movements, Gold’s latest rally stems from a weakening US Dollar. While no new all-time highs are anticipated, Gold has erased its early-week losses and is now trading flat for the week.

Gold has reclaimed the $2,900 level and is now above the daily Pivot Point at $2,895. At the time of writing, it is testing the R1 resistance near $2,910. A successful breakout could see the metal targeting the R2 resistance at $2,933, aligning with last week’s highs.

On the downside, strong support lies at $2,880, which has held firm on Monday and Tuesday. If this level breaks, the next support is at $2,873 (S1), with a further decline potentially reaching $2,857, where the S2 support and the March 3 low converge.