- The Mexican Peso remains steady as traders await updates on the U.S. presidential election outcome.

- The election winner could significantly influence the Peso in the coming days.

- On the technical side, USD/MXN is still trading below the chart gap created after its Monday drop.

The Mexican Peso (MXN) fluctuates between modest gains and losses on Tuesday as traders await the U.S. presidential election results, which are expected to be a significant driver for the Peso in the days ahead.

If Democratic nominee Kamala Harris wins, analysts expect a positive impact on the Peso, while a Republican win by Donald Trump could be negative due to his previous threats of imposing tariffs on Mexican imports, according to financial news source El Financiero.

According to the election forecaster 538.com, Harris holds a slight lead with a 50% probability of winning, compared to Trump’s 49% chance, leaving a 1% probability of no decisive winner. Harris’s recent lead reversal may help explain the Peso’s strengthening on Monday.

Mexican Peso: Four potential scenarios based on U.S. election outcomes

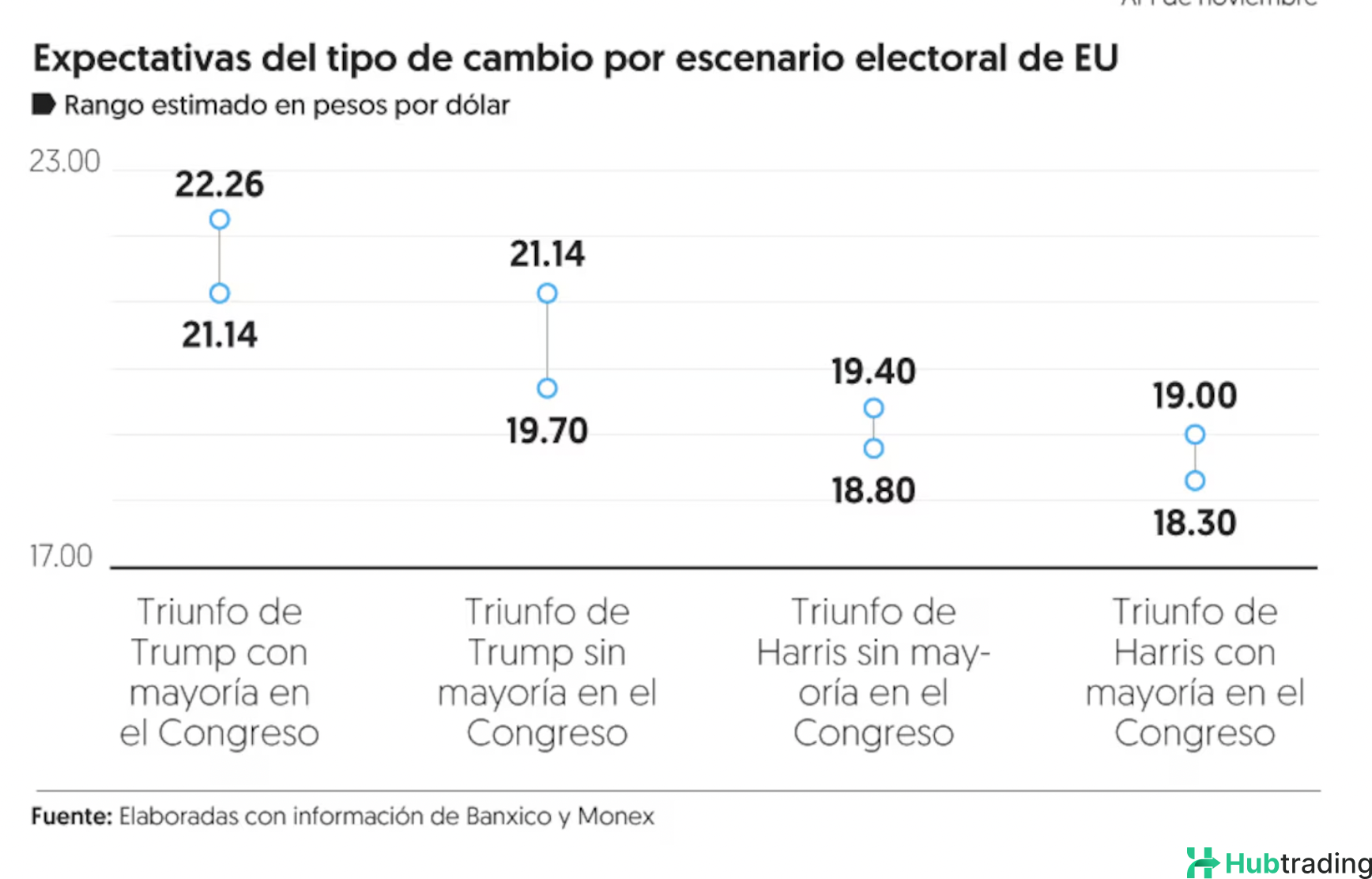

According to El Financiero, the Mexican Peso's exchange rate with the U.S. Dollar (USD) is projected to fluctuate between a low of 18.30 and a high of 22.26, depending on the outcome of the U.S. presidential election.

The following graphic illustrates the USD/MXN range under four possible election scenarios.

Domestic pressures: Mexican Peso eyes Supreme Court decision on judicial reform

The Peso also faces potential volatility from domestic developments, as the Mexican Supreme Court deliberates on the constitutionality of a proposed judicial reform. The reform, already passed by parliament, would require judges to be elected by popular vote rather than appointed—a move supporters argue will curb corruption but critics warn could undermine judicial independence.

Mexican President Claudia Sheinbaum stated she would respect the court's decision, though she emphasized that “eight justices cannot be above the people.” Recently, Supreme Court Judge Juan Luis González Alcántara suggested a compromise limiting the election to Supreme Court judges only.

In response to anticipated delays, Mexican parliament passed a law preventing courts from blocking the implementation of legislation. If the Supreme Court rules against the reform, the government could still proceed, which experts say could lead Mexico into a constitutional crisis, with possible economic impacts and investor confidence concerns.

Technical Analysis: USD/MXN shows a gap, continues within rising channel

USD/MXN remains below the gap it formed on Monday, following the completion of a bullish “abc” pattern last week.

USD/MXN 4-hour Chart

USD/MXN appears to be in a broader uptrend across short, medium, and long-term timeframes, trading within a bullish rising channel. Given that trends tend to persist, there’s a mild upward bias for the pair, suggesting a likelihood of closing the gap in the coming sessions.