- GBP/USD struggles to maintain its recovery after hitting a multi-month low, with soft UK CPI data adding pressure on the pair.

- Market focus shifts to upcoming US inflation data, which could influence the next move in the currency pair.

GBP/USD Price Forecast: Bulls Overlook Softer UK CPI Data; Focus Shifts to US Inflation

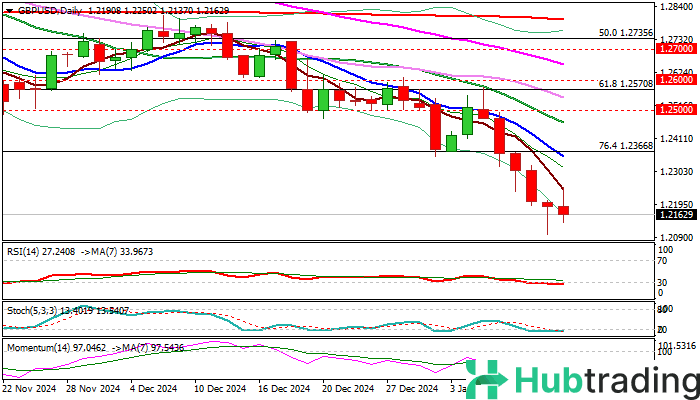

The GBP/USD pair struggles to build on its modest recovery from the 1.2100 level, the lowest point since November 2023, touched earlier this week. Sellers return on Wednesday, and the pair's intraday decline accelerates following the release of softer UK consumer inflation data. However, a subdued US Dollar (USD) provides some relief, allowing GBP/USD to rebound slightly from the mid-1.2100s.

The UK Office for National Statistics (ONS) reported that the headline Consumer Price Index (CPI) rose by 2.5% YoY in December, below the expected increase to 2.7% from 2.6% in November. Additionally, core CPI, which excludes volatile food and energy items, grew by 3.2% in December, down from 3.5% in November and below the expected 3.4%.

GBP/USD Outlook: Near Multi-Month Lows, with UK and US CPI Reports in Focus

GBP/USD came under renewed pressure on Tuesday, testing its recent multi-month low of 1.2099 after failing to sustain a recovery from Monday’s sharp downside rejection at the 1.2250 zone.

Bears have regained control, and a break below the 1.2099 low (which also marks the monthly cloud base) could open the door to testing the 1.2037/00 area (the October 4, 2023 low and a psychological level). Daily technical indicators remain in a bearish setup, although oversold conditions could temporarily stall further downside movement.