- The Bank of Canada (BoC) is expected to reduce its policy rate by 50 basis points.

- The Canadian Dollar is under pressure against the US Dollar.

- Headline inflation in Canada has fallen below the BoC’s 2% target.

- The BoC will also publish its Monetary Policy Report (MPR).

Broad expectations are building that the Bank of Canada (BoC) will implement a policy rate cut for the fourth consecutive meeting on Wednesday. This time, consensus points to a 50 basis point reduction, lowering the benchmark interest rate to 3.75%.

Since the start of the year, the Canadian Dollar (CAD) has weakened against the US Dollar (USD), with USD/CAD reaching nearly a two-year high around 1.3950 in early August. After a notable appreciation in August, the CAD has since taken a downward trajectory, currently hovering in the mid-1.3800s against its North American counterpart.

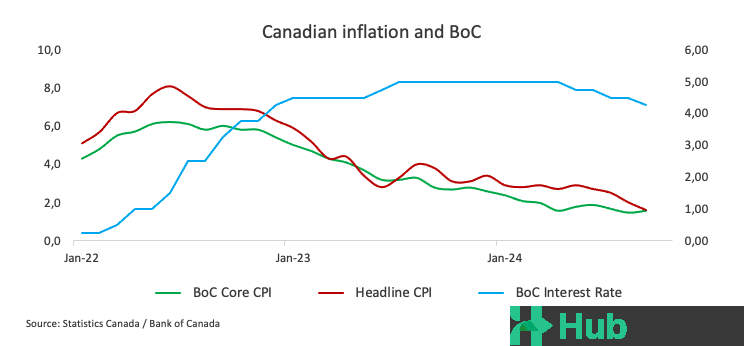

In September, Canada’s annual inflation rate, as measured by the headline Consumer Price Index (CPI), fell below the central bank’s 2% target for the first time since the Covid-19 pandemic, showing a 1.6% increase over the past year. The BoC's core CPI, although showing a slight rebound last month, remains significantly below the bank’s threshold.

The BoC aims to keep consumer prices around the midpoint of its 1%-3% range.

A Dovish Cut on the Horizon

Despite the anticipated rate cut, the central bank's overall stance is expected to lean dovish, especially given declining inflation, a cooling labor market, and GDP growth falling short of the bank’s latest forecasts. Currently, swaps markets indicate a roughly 70% chance of a 50 basis point reduction on Wednesday.

A BoC survey released on October 11 highlighted that Canadian firms are experiencing weak demand and slow sales growth, though there were signs of marginal improvement in conditions during Q3. The survey suggested that rate cuts could potentially enhance these conditions.

Following the rate cut on September 4, the Minutes published on September 18 revealed a divided Governing Council regarding the inflation outlook before deciding on the third consecutive cut. The BoC noted the need to balance ongoing high costs of shelter and services with a slowing economy and rising unemployment.

In his latest comments on September 24, BoC Governor Tiff Macklem indicated that further rate cuts are a reasonable expectation as the bank makes progress toward its 2% inflation target. He emphasized the goal of achieving stronger economic growth to absorb remaining slack in the economy, stating, "We need to stick the landing."

Analysts at Standard Chartered now expect the BoC to lower the policy rate by 50 basis points (instead of 25 bps) at both the October and December meetings, bringing the year-end rate down to 3.25% (from the previous 3.75%). They believe the September inflation undershoot and declining inflationary pressures from shelter costs support the case for faster easing.

Impact on USD/CAD

The Bank of Canada will announce its policy decision at 13:45 GMT on Wednesday, followed by a press conference from Governor Macklem at 14:30 GMT.

With no major surprises expected, the impact on the Canadian Dollar (CAD) is likely to hinge more on the central bank's messaging than the rate decision itself.

Pablo Piovano, Senior Analyst at HubTrading, notes that USD/CAD has been on a strong upward trend since late September, reaching October highs near 1.3850 this week, largely driven by a robust recovery of the US Dollar.

He identifies the immediate target at the 2024 peak of 1.3946 recorded on August 5. He adds, "Occasional bearish attempts could prompt USD/CAD to retest the provisional 100-day SMA at 1.3664, ahead of the more significant 200-day SMA at 1.3622, before approaching the September low of 1.3418 seen on September 25.”