Trump’s second presidency is expected to usher in a period of economic volatility, with short-term gains from tax cuts and business-friendly policies potentially offset by long-term risks from immigration restrictions, trade wars, and rising government debt. While the initial economic outlook may be positive, particularly for high-income households and U.S. manufacturers, the long-term sustainability of Trump’s policies is uncertain, particularly if his fiscal and trade policies lead to higher inflation, reduced global trade, and lower economic growth. As the U.S. navigates these challenges, Europe and emerging markets will also face significant economic disruptions, further exacerbating global uncertainty.

Donald Trump’s victory promises a lower-tax environment that should boost economic sentiment and consumer spending in the short term. However, his administration’s focus on tariffs, immigration restrictions, and higher borrowing costs will likely create significant

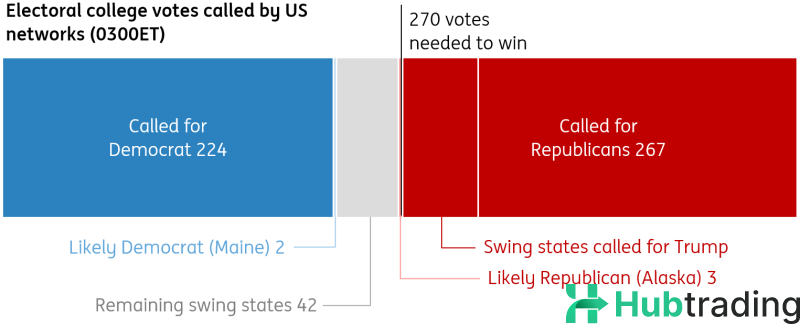

US Presidential Election Results

(As of 0300 ET)

Chart Source: New York Times

Tax Cuts, Immigration Controls, and Protectionism: The Trump Presidency and Its Economic Impact

Donald Trump has been elected the 47th President of the United States, making him only the second president after Grover Cleveland to serve non-consecutive terms. While pre-election polls suggested a tight race, financial markets increasingly priced in a Trump victory, with rising equity markets, a stronger dollar, and higher Treasury yields in the lead-up to the election. The path ahead for Trump’s policies, however, hinges on his ability to navigate a potentially divided Congress, particularly if Democrats retain control of the House.

Key Immediate Challenges and Legislative Agenda

A pressing issue for the new administration will be the federal debt limit, which will be reinstated on January 2. Treasury Secretary Janet Yellen will use "extraordinary measures" to continue fiscal operations until a deal can be struck to lift or suspend the debt ceiling. Trump’s ability to pass significant policy measures will depend on whether Republicans achieve a clean sweep of the presidency, Senate, and House. If Democrats win the House, there could be protracted negotiations, potentially stalling key policies such as tax cuts.

Trump’s main policy priorities are:

- Extending and modifying the Tax Cuts and Jobs Act (TCJA), due to expire in 2025. He aims to lower corporate taxes further and make other reforms, such as exempting tips from taxation.

- Restricting immigration, particularly from the southern border, and cracking down on both illegal and legal immigration to the U.S.

- Implementing tariffs designed to raise revenue, encourage re-shoring of manufacturing, and boost U.S. economic growth and jobs.

Domestic Agenda: Immigration, Taxation, and Regulation

Trump is likely to start his presidency by focusing on domestic policies, particularly immigration. His proposed reforms include mass deportations of illegal immigrants, stricter border controls, and reductions in legal immigration. He also plans to reduce government regulations, particularly in the energy and environmental sectors, citing concerns over waste, abuse, and inefficiency in federal agencies.

Tax policy will be the next major focus. If Republicans control both the Senate and House, an extension of the TCJA should be relatively straightforward, potentially with adjustments. However, if Congress remains divided, the process could face significant delays and compromises, especially regarding corporate tax cuts. The clock is ticking as the current tax cuts expire at the end of 2025.

Once domestic policies are set in motion, Trump will likely turn to trade policy. Aggressive tariffs on Chinese imports, followed by tariffs on other goods, are expected to roll out starting in late 2025 or early 2026. These moves are part of his "America First" economic vision, which aims to reduce reliance on foreign manufacturing and boost U.S. jobs.

Foreign Policy: A Transactional and Isolationist Approach

Trump’s foreign policy priorities are somewhat less clear but will likely continue to reflect his "America First" stance. Although containment of China will remain a major focus, his broader foreign policy could become more transactional and isolationist. While Trump may pursue efforts to resolve conflicts in Ukraine and the Middle East, his approach will likely prioritize U.S. interests over traditional alliances.

His past efforts to normalize relations between Israel and Arab nations through the Abraham Accords are likely to continue, but his stance on Ukraine could shift significantly. Trump might reduce U.S. military aid to Ukraine to push for a negotiated settlement with Russia, though it remains unclear whether sanctions on Russia would be lifted.

Economic Consequences: Growth Risks and Inflationary Pressures

In the short term, tax cuts and a pro-business environment could keep consumer and investor sentiment relatively positive. High-income households, buoyed by asset price growth and rising interest rates, may continue to drive consumer spending. A smooth transition to the new administration could provide market clarity and support economic stability.

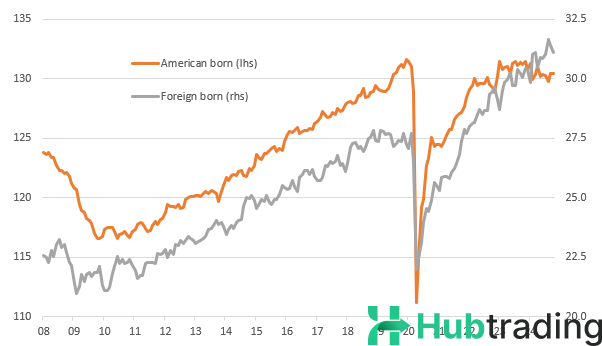

However, the medium- to long-term economic outlook is less certain. Trump’s policies on immigration and trade could create significant headwinds for U.S. growth. Reduced immigration and the deportation of millions of foreign-born workers could exacerbate labor shortages, particularly in industries like agriculture and construction. The U.S. workforce, which has seen an increase in foreign-born workers, is already declining due to lower birth rates and aging demographics. Without a sufficient workforce, wage inflation and slower economic growth could result, unless productivity dramatically increases.

Tariffs, which Trump sees as a way to protect U.S. industry and generate revenue, could also create supply-side constraints. These tariffs would raise costs for importers (typically U.S. retailers) who would have to either absorb these costs or pass them on to consumers. The result could be higher inflation, eroding consumer spending power and retail margins, particularly in sectors reliant on imported goods. Furthermore, retaliation from foreign nations could escalate into a trade war, negatively impacting U.S. exporters and global supply chains.

One of the largest risks to long-term growth is the projected increase in U.S. government borrowing. The combination of tax cuts, tariffs, and increased spending could add an estimated $7.75 trillion to the national debt over the next decade, exacerbating concerns about fiscal sustainability. As the U.S. government borrows more, borrowing costs for consumers and businesses are likely to rise, pushing up interest rates across the economy.

The Federal Reserve and Interest Rates

The Federal Reserve’s monetary policy will be influenced by Trump’s fiscal agenda. Given the expected rise in government borrowing and the risk of higher inflation, the Fed may raise interest rates to keep inflation in check. This could put upward pressure on long-term Treasury yields, increasing borrowing costs for the U.S. government and businesses. Trump could, however, push for a more accommodative Fed to support economic growth, especially in the lead-up to the 2028 election.

Europe's Economic Outlook: Recession Risks

The prospect of a new trade war with the U.S. could push the eurozone economy from sluggish growth into recession, particularly in countries like Germany, which relies heavily on trade with the U.S. Tariffs on European automotive exports could hit Germany hard. Moreover, uncertainty surrounding Trump’s approach to Ukraine and NATO could destabilize the eurozone, even before any tariffs are imposed. As a result, the European Central Bank (ECB) is likely to take a more aggressive stance on monetary easing, with rate cuts expected as early as December 2024.

Financial Markets: Bond Yields and Credit Spreads

The market’s reaction to Trump’s victory is expected to be more muted than in 2016, when his win caught many by surprise. Treasury yields have already risen significantly in anticipation of a Trump presidency, and further increases are likely as investors adjust to the prospect of higher U.S. borrowing costs and inflation. The spread between U.S. and European bond yields could widen further, reflecting heightened uncertainty about global trade and economic growth.

Credit markets could also experience volatility, with U.S. credit spreads likely tightening, especially in the short term. European credit markets, less influenced by U.S. policies, may see only modest tightening, but the long-term outlook remains fraught with risk due to potential inflationary pressures.

Currency Markets: A Stronger Dollar

In the wake of Trump’s election, the U.S. dollar has strengthened, with protectionist policies likely driving the currency higher against most global counterparts. The dollar’s strength could weigh on emerging market currencies, especially in regions like Central and Eastern Europe, which are vulnerable to U.S. trade policies. In the eurozone, the EUR/USD exchange rate could come under pressure, with a move toward parity possible by 2025 as Trump’s protectionist policies fully take effect.

Trump’s second presidency is expected to usher in a period of economic volatility, with short-term gains from tax cuts and business-friendly policies potentially offset by long-term risks from immigration restrictions, trade wars, and rising government debt. While the initial economic outlook may be positive, particularly for high-income households and U.S. manufacturers, the long-term sustainability of Trump’s policies is uncertain, particularly if his fiscal and trade policies lead to higher inflation, reduced global trade, and lower economic growth. As the U.S. navigates these challenges, Europe and emerging markets will also face significant economic disruptions, further exacerbating global uncertainty.