- The U.S. ISM Manufacturing PMI for August showed slight improvement, rising to 47.2, indicating a slower pace of contraction in the sector.

- The report highlighted increased inflationary pressures, with the prices index climbing to 54.0, while the employment index also saw improvement.

- Despite these gains, the overall outlook remains cautious, with weak demand, declining new orders, and a drop in production continuing to challenge the manufacturing sector.

The U.S. ISM Manufacturing PMI for August registered at 47.2, showing a slight improvement from July’s reading of 46.8 but falling short of the consensus estimate of 47.5. This suggests that the manufacturing sector remains in contraction, but at a slower pace. The report highlighted a rise in the prices index from 52.9 to 54.0, indicating an uptick in inflationary pressures within the sector. Additionally, the employment index improved from 43.4 to 46.0, offering a glimmer of hope for the labor market. However, the overall downturn was driven by a continued decline in new orders and a drop in production, pointing to weak demand and subdued output.

Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee, commented that demand remains weak, with companies hesitant to invest in capital and inventory due to the impact of current federal monetary policies and the uncertainty surrounding the upcoming election. Fiore noted that inputs remained accommodative, but the overall outlook for the sector remains cautious.

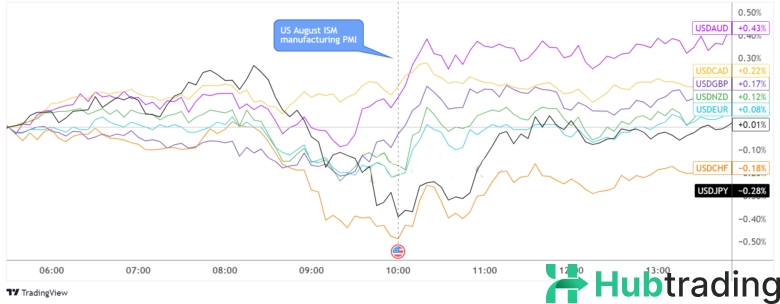

U.S. dollar vs. Major Currencies: 5-min

Following the release of the PMI data, the U.S. Dollar strengthened across most major currencies, with dollar bulls finding some relief from the slight uptick in employment and prices components. The improvement in the employment index, in particular, raised optimism ahead of the upcoming Non-Farm Payrolls (NFP) report. Despite the overall mixed economic data, the Greenback was able to maintain most of its post-PMI gains, except against the Canadian Dollar, where it traded sideways in the hours following the release.

At the same time, the construction spending report revealed a 0.3% monthly decline for July, which was worse than the expected 0.1% increase. Additionally, the RCM/TIPP consumer optimism index showed a small improvement, providing some positive sentiment amid the broader economic data.