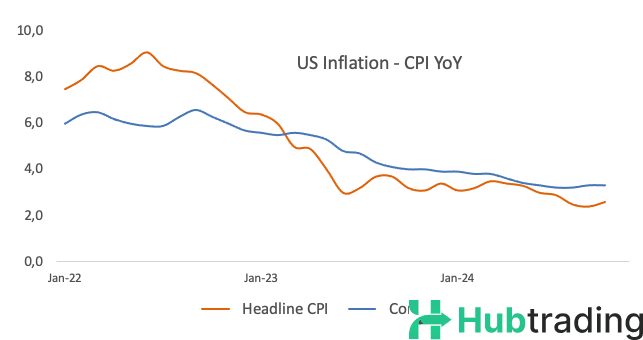

- The US Consumer Price Index (CPI) is projected to increase by 2.7% year-on-year in November.

- Core CPI inflation is expected to remain steady at 3.3% from the previous month.

- The Federal Reserve is anticipated to reduce interest rates by 25 basis points in December.

The US Consumer Price Index (CPI) report for November, a crucial indicator of inflation, will be released on Wednesday at 13:30 GMT by the Bureau of Labor Statistics (BLS). Markets are anticipating significant movements in the US Dollar (USD) as the data may influence the Federal Reserve's (Fed) future interest rate decisions.

What to expect in the CPI data report?

Inflation in the US is forecast to increase by 2.7% year-on-year in November, slightly up from 2.6% in October. Core CPI, which excludes volatile food and energy prices, is expected to hold steady at 3.3%. On a monthly basis, both headline CPI and core CPI are anticipated to rise by 0.3%.

TD Securities analysts preview the report, expecting core inflation to remain largely unchanged in November, driven mainly by rising goods prices, while easing housing inflation could provide some relief. Headline CPI is expected to inch up to 2.7%, with core inflation holding steady at 3.3%.

In his remarks on December 4, Federal Reserve Chair Jerome Powell noted that the economy had outperformed earlier forecasts, allowing the Fed to take a more measured approach to rate changes. Powell emphasized that the economy is stronger than expected, even as inflation remains slightly above target, shaping the Fed's cautious outlook as it prepares for its December 17-18 meeting.

Impact on EUR/USD

The incoming Trump administration is expected to pursue stricter immigration policies, a more relaxed fiscal stance, and the reintroduction of tariffs on imports from China and Europe. These factors could raise inflationary pressures, potentially prompting the Fed to slow or even halt its easing cycle, supporting the US Dollar.

However, with signs of cooling in the US labor market and persistent inflation, the November CPI report is unlikely to drastically shift the Fed’s stance. Markets are pricing in an 85% probability of a 25-basis point rate cut in December, according to the CME Group’s FedWatch Tool.