- The US Dollar weakens as US GDP comes in softer than expected

- Markets note that the inflation component in the GDP release remains unchanged.

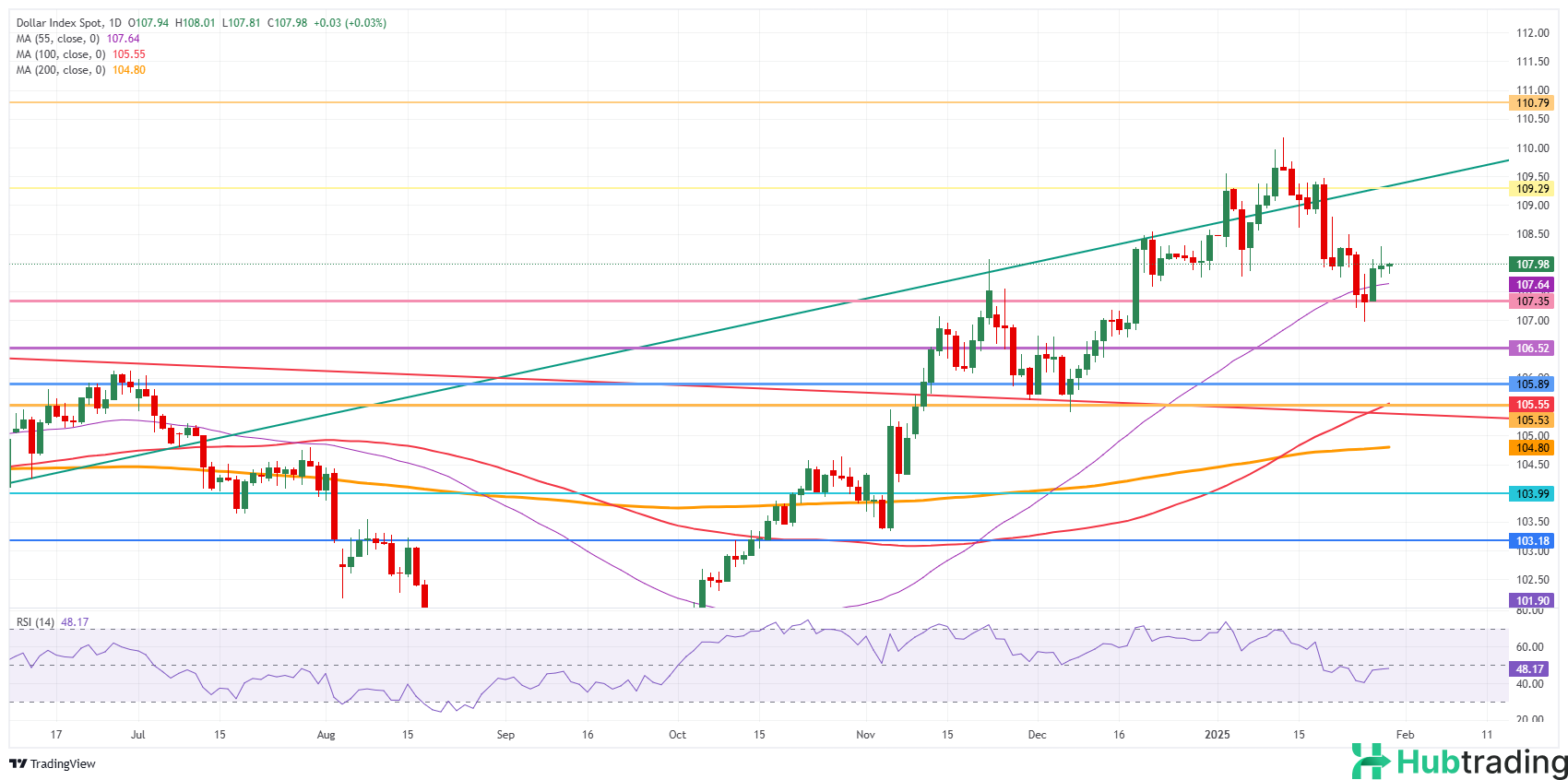

- The US Dollar Index (DXY) stays below 108.00, struggling to find direction.

The US Dollar Index (DXY), which measures the US Dollar against six major currencies, is weakening following the fourth-quarter US GDP release. Meanwhile, the European Central Bank (ECB) has cut its policy rate by 25 basis points, as expected. After the Federal Reserve's (Fed) hawkish pause, markets are watching to see if the ECB will comment on the US political landscape with Donald Trump back in office.

Fed Chairman Jerome Powell, however, avoided commenting on Trump-related questions, reinforcing the Fed's stance on independence. Some traders interpret the Fed's hawkish hold as a signal to Trump that monetary policy will remain data-driven rather than influenced by the White House.

Daily Market Movers: Softer Again

- Asian Markets: Trading remains quiet this week due to the Lunar New Year, which began on Tuesday. Chinese traders will return to the markets on February 5.

- European Central Bank (ECB): As expected, the ECB cut its monetary policy rate by 25 basis points.

- US Q4 GDP: The preliminary GDP report missed expectations:

- Headline GDP fell to 2.3%, below the 2.6% consensus and down from 3.1% in the previous quarter.

- Personal Consumption Expenditure Prices (PCE) jumped to 2.3% from 1.5%.

- Core PCE remained unchanged at 2.2%, below the 2.5% forecast.

- US Jobless Claims: For the week ending July 24, initial jobless claims dropped to 207,000, beating the expected 220,000 and down from 223,000 last week. Continuing claims fell to 1.858 million from 1.900 million.

- ECB Speech: At 13:45 GMT, ECB President Christine Lagarde will deliver her monetary policy speech, followed by a Q&A session.

- Equities: Stock markets remain positive, with all major European and US indices holding onto gains.

- Fed Outlook: The CME FedWatch Tool shows an 80% probability that the Federal Reserve will keep rates unchanged at its next meeting on March 19.

- US Bond Yields: The US 10-year Treasury yield is trading around 4.502% after hitting a fresh yearly low of 4.484%.

US Dollar Index (DXY) Technical Analysis: Struggling for Direction

The US Dollar Index (DXY) remains stagnant as US yields continue to decline. Markets are increasingly concerned about pressure from President Trump on the Federal Reserve, as he pushes for lower interest rates and borrowing costs. Following last night's Fed decision, tensions could escalate further, with Trump potentially resorting to unconventional tactics that might undermine the Fed's credibility.

Key Levels to Watch:

- Upside: The psychological resistance at 108.00 remains a hurdle for a daily close. A breakout could see the index rise toward 109.30 (July 14, 2022, high and rising trendline) to recover last week's losses. Further resistance sits at 110.79 (September 7, 2022, high).

- Downside: Strong support lies at the 55-day Simple Moving Average (SMA) at 107.64 and the October 3, 2023, high at 107.35. If these levels fail, the Relative Strength Index (RSI) suggests further downside potential, with 106.52 and 105.89 emerging as key zones where US Dollar bulls may look to regain control.