- The United States Gross Domestic Product is projected to grow at an annualized rate of 3.0% in Q3.

- The US economy continues to surpass its G10 counterparts.

- Investors are expecting the Federal Reserve to lower interest rates by 25 basis points in November.

The US Bureau of Economic Analysis (BEA) is set to release the preliminary estimate of Gross Domestic Product (GDP) for the July-September quarter on Wednesday. Analysts expect the report to show an annualized economic growth rate of 3.0%, matching the growth recorded in the previous quarter.

Unveiling US Economic Growth: GDP Forecast Insights

On Wednesday at 12:30 GMT, the Bureau of Economic Analysis (BEA) will publish its first estimate of Q3 GDP, with initial projections indicating a robust annualized growth rate of 3.0%. This figure aligns with the previous quarter's expansion and demonstrates the resilience of the US economy, which continues to outperform its G10 peers.

The Federal Reserve's (Fed) updated Summary of Economic Projections from the September meeting revealed some changes from June. The median forecast for real GDP growth remained steady at 2.0% for 2024, 2025, and 2026, with a long-term forecast of 1.8%.

Additionally, the Fed raised its median unemployment rate projections to 4.4% for both 2024 and 2025, 4.3% for 2026, and 4.2% in the long term, compared to earlier estimates of 4.0%, 4.2%, 4.1%, and 4.2%, respectively.

On the inflation front, the Fed revised down the median estimate for the core Personal Consumption Expenditures (PCE) price index to 2.6% for 2024, 2.2% for 2025, and 2.0% for 2026, down from previous projections of 2.8%, 2.3%, and 2.0%.

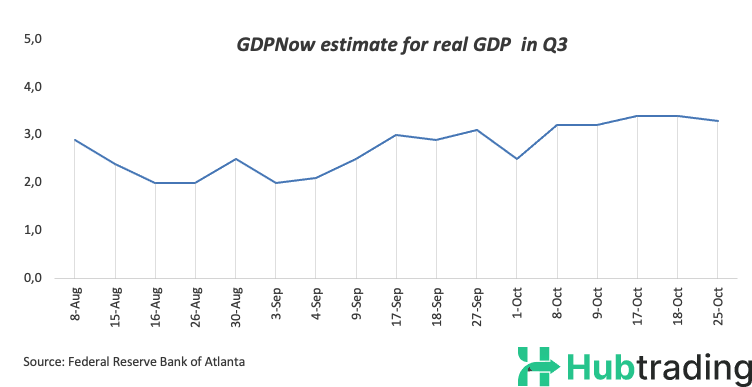

The latest GDPNow forecast from the Federal Reserve Bank of Atlanta, released on Friday, predicts that the US economy expanded at an annual rate of 3.3% in Q3.

Market observers will closely monitor the GDP Price Index, which tracks changes in the prices of goods and services produced domestically, including exports but excluding imports. For Q3, the GDP Price Index is expected to rise by 2.7%, up from 2.5% in the second quarter.

The GDP report will also include quarterly Personal Consumption Expenditures (PCE) Price Index figures, including the core PCE Price Index, which is the Fed's preferred inflation measure.

Ahead of the GDP release, analysts at TD Securities noted, “US Q3 GDP strength is likely to persist with a 3% gain, driven by strong domestic demand and a resilient consumer base.”

What to Expect from the GDP Release and Its Impact on the USD

The US GDP report will be published at 12:30 GMT on Wednesday. In addition to the headline GDP figure, changes in private domestic purchases and the PCE Price Index could significantly impact the US Dollar (USD).

Recent sticky inflation readings in September, coupled with a robust US labor market, have heightened expectations for a modest Fed rate cut in November. According to the CME FedWatch Tool, a 25 basis point reduction is nearly fully priced in.

A strong GDP figure could provide the Fed with further justification for a small rate cut next month. Conversely, a disappointing print—though unlikely—might lead to a brief pause for the Greenback.

Pablo Piovano, Senior Analyst at HubTrading, offered his technical outlook for the US Dollar Index (DXY): “Amidst the ongoing rally, the next key target is the October 29 high of 104.63. Clearing this level could initiate a potential test of the weekly high of 104.79 from July 30.”

“On the downside, strong support remains at the year-to-date low of 100.15 from September 27. If selling pressure reemerges and the DXY breaches this level, it may retest the psychological milestone of 100.00, potentially leading to a drop to the 2023 low of 99.57 from July 14,” added Pablo.