- USD/JPY declines as US GDP growth slows to 2.3%, missing the 2.6% forecast.

- Stronger jobless claims data fails to lift the US Dollar amid broader economic concerns.

- Yen gains strength on policy divergence, with the Fed holding rates while the BoJ maintains a tighter stance.

The USD/JPY retreats in early North American trading after weaker-than-expected US economic data, following the Federal Reserve's decision to keep interest rates unchanged. The pair trades at 154.09, down 0.76%.

US GDP Miss Weighs on the Dollar

The US GDP for Q4 2024 slowed to 2.3%, missing the 2.6% forecast and dropping from 3.1% in the previous quarter. Despite better-than-expected jobless claims, with 207K filings compared to the 220K estimate, the Greenback weakened, driving USD/JPY below 154.00 before rebounding slightly to 154.00.

Yen Strengthens on Policy Divergence

The Japanese Yen extended gains as the policy gap between the Bank of Japan (BoJ) and the Federal Reserve widened, favoring the Yen's appreciation. Given the GDP slowdown, further USD/JPY downside is likely as concerns grow over the pace of US economic deceleration.

Key Data Releases Ahead

- Japan: Unemployment Rate, Industrial Production, and Retail Sales.

- US: Fed's preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index, along with speeches from Fed officials.

USD/JPY Technical Outlook

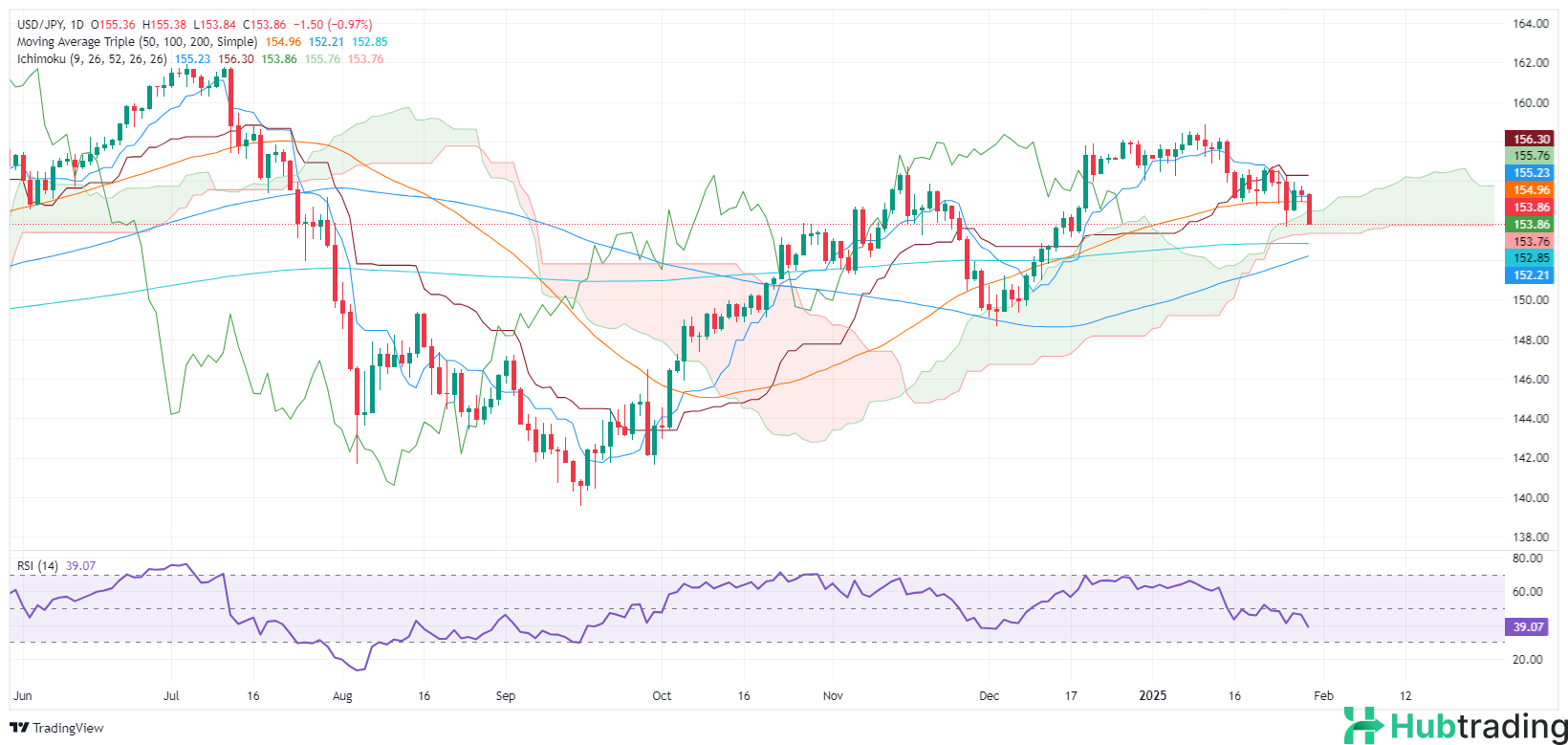

- The pair has fallen into the Ichimoku Cloud (Kumo), signaling growing bearish momentum after breaking below the 50-day Simple Moving Average (SMA) at 154.97.

- The Relative Strength Index (RSI) remains bearish, reinforcing downward pressure.

- A break below the Senkou Span B at 153.76 could drive USD/JPY further down toward the 200-day SMA at 152.85 and the 100-day SMA at 152.22.