- USD/JPY extends its uptrend, supported by a stable US 10-year Treasury yield holding at 4.58%.

- President Trump’s plans for new tariffs on Chinese and European goods boost the US Dollar’s recovery.

- The Bank of Japan considers a rate hike amid improving wage growth and inflation, weighing on the Yen.

USD/JPY advanced during early North American trading, gaining 0.41% and breaking above the 156.00 mark. The move was fueled by President Trump’s trade rhetoric targeting Canada, Mexico, the EU, and China, alongside a steady US 10-year Treasury yield and a firmer US Dollar.

USD/JPY Rises Above 156.00, Dismissing BoJ Rate Hike Speculation

On Tuesday, President Trump stated his administration is considering a 10% tariff on Chinese goods starting February 1, with potential duties on European goods also under review. This tempered tone from Trump’s inauguration speech helped the US Dollar recover from Monday’s 1.22% drop.

The US Dollar Index (DXY), which measures the Greenback against six major currencies, held steady at 108.13, while the US 10-year Treasury note maintained a 4.58% yield.

Despite expectations that the Bank of Japan (BoJ) may raise interest rates at its January 23-24 meeting, the Japanese Yen softened. BoJ Governor Kazuo Ueda is under pressure as Japanese retailers raise wages for a second consecutive year amid rising inflation and labor shortages.

Economic Calendar and Trade Data

The US economic docket remains quiet, while Japan’s Balance of Trade for December is expected to narrow its deficit to ¥-55 billion from ¥-117.6 billion.

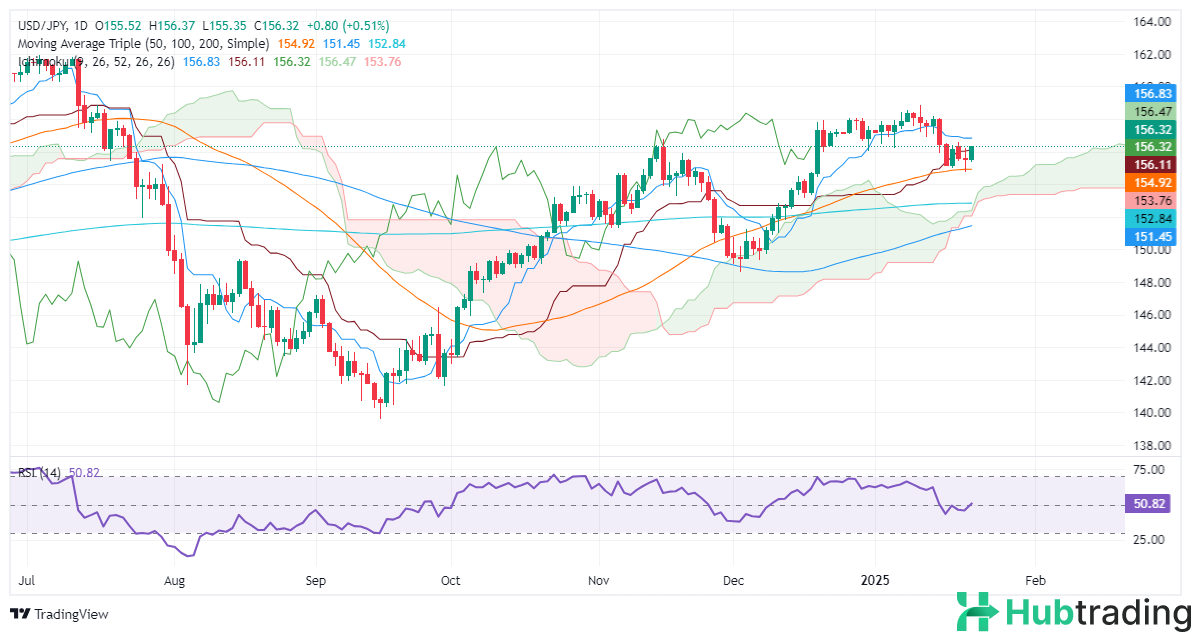

USD/JPY Technical Analysis

USD/JPY bounced from a weekly low of 154.76, just above a four-month-old support trendline originating from October 2024 lows of 139.56. Buyers reclaimed ground above the 155.00 and 156.00 levels, targeting the Tenkan-sen at 156.82. A break above this level could lead to a test of 157.00, with further resistance at the January 14 high of 158.20.

On the downside, a fall below 156.00 would expose 155.00, followed by the January 21 swing low at 154.76.