- XRP is trading at $0.5879, inching closer to the key psychological level of $0.60.

- Ripple is gearing up for the launch of its stablecoin, despite the SEC head’s continued tough stance on cryptocurrency regulation.

- The Grayscale XRP Trust's NAV has risen to $11.49, indicating increased institutional demand for the asset.

Ripple (XRP) has gained 2.3% since the start of the week, driven by key factors such as the upcoming launch of the Ripple USD (RUSD) stablecoin, the performance of the Grayscale XRP Trust, and growing institutional demand for the altcoin.

The Net Asset Value (NAV) of the Grayscale XRP Trust, which reflects the intrinsic value per share, is calculated daily according to the official website. Although NAV doesn’t directly impact the underlying asset’s price, its trend provides insight into the share price’s trajectory. Investors monitor NAV to gauge changes in the fund’s value, which can signal institutional demand.

In a recent interview, the head of the Securities & Exchange Commission (SEC) noted that cryptocurrency is not “incompatible” with existing securities laws.

Daily Digest Market Movers: XRP Primed for a Rally with Key Catalysts

- XRP is edging closer to the crucial $0.6000 mark, trading at $0.5843 early Thursday.

- Ripple, the cross-border payment firm, recently unveiled its plans to launch the Ripple USD (RUSD) stablecoin. The stablecoin aims to connect global financial institutions and facilitate cross-border payments through the XRP Ledger (XRPL) and Ethereum mainnet.

- XRP holders are eagerly awaiting the stablecoin’s launch date, while regulatory clarity from the Securities & Exchange Commission (SEC) is still needed for the RUSD roll-out in the U.S.

- Another key driver is the performance of Grayscale’s single-asset investment fund, the Grayscale XRP Trust. According to the official website, its NAV stands at $11.49, after peaking at $11.77 earlier this week on Tuesday.

- The ongoing SEC vs. Ripple lawsuit remains a key market driver. While the case concluded with a partial win for both parties, there is still a possibility of an appeal from the regulator. Though the SEC has yet to comment on a potential appeal, SEC Chair Gary Gensler reiterated in a recent CNBC interview that existing securities laws provide sufficient clarity, stating that “there’s nothing incompatible about the field with the basic protections that are in the securities laws.”

- Despite XRP being legally recognized as a non-security in secondary-market transactions, it was still classified as a security in sales to institutions. Should the SEC decide to appeal the July 2023 ruling by Judge Analisa Torres, it could potentially revoke XRP’s non-security status. This uncertainty has left XRP traders closely watching every move by the regulator.

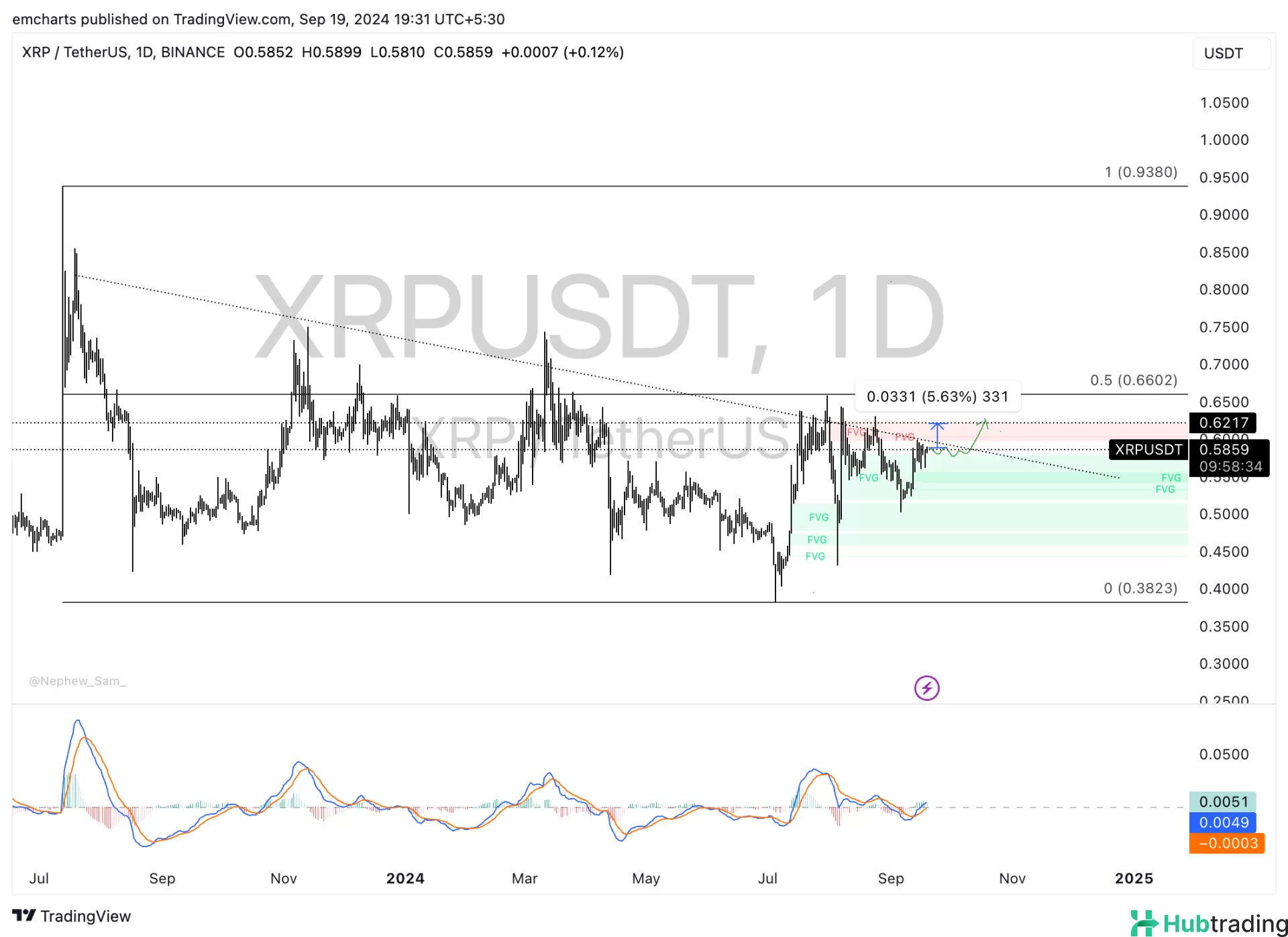

Technical Analysis: XRP Poised for Nearly 6% Gains if $0.5500 Support Holds

XRP has made multiple attempts to break out of its downtrend throughout July, August, and September but has remained range-bound. The altcoin has been trading between a high of $0.6434 on August 7 and a low of $0.5026 on September 6.

For nearly 12 days, XRP has maintained support above $0.5026 and is now finding support at $0.5500. If XRP holds above this level, it could rally to $0.6217, representing a potential 6% gain.

The Moving Average Convergence Divergence (MACD) indicator further supports this bullish outlook, with green histogram bars above the neutral line indicating positive momentum in XRP's price.

A daily candlestick close below the critical $0.5500 support level could invalidate the bullish outlook for XRP. In this case, XRP may target a liquidity sweep within the imbalance zone between $0.5413 and $0.5556.